As we entered 2025, U.S. markets faced a sharp downturn, rattled by geopolitical tensions, shifting economic policies, and wavering investor confidence. As of March 13th, the S&P 500 has returned -5.2% year-to-date, while the Nasdaq Composite saw a steeper decline of -9.5% over the same period.

At Arta, we believe long-term wealth growth isn’t about chasing short-term gains—it’s about intelligent, disciplined risk management. During this volatile period, our public equity strategies remained resilient. Our Defensive Growth strategy maintained strong allocations to stable sectors like consumer staples and healthcare, providing much-needed stability.

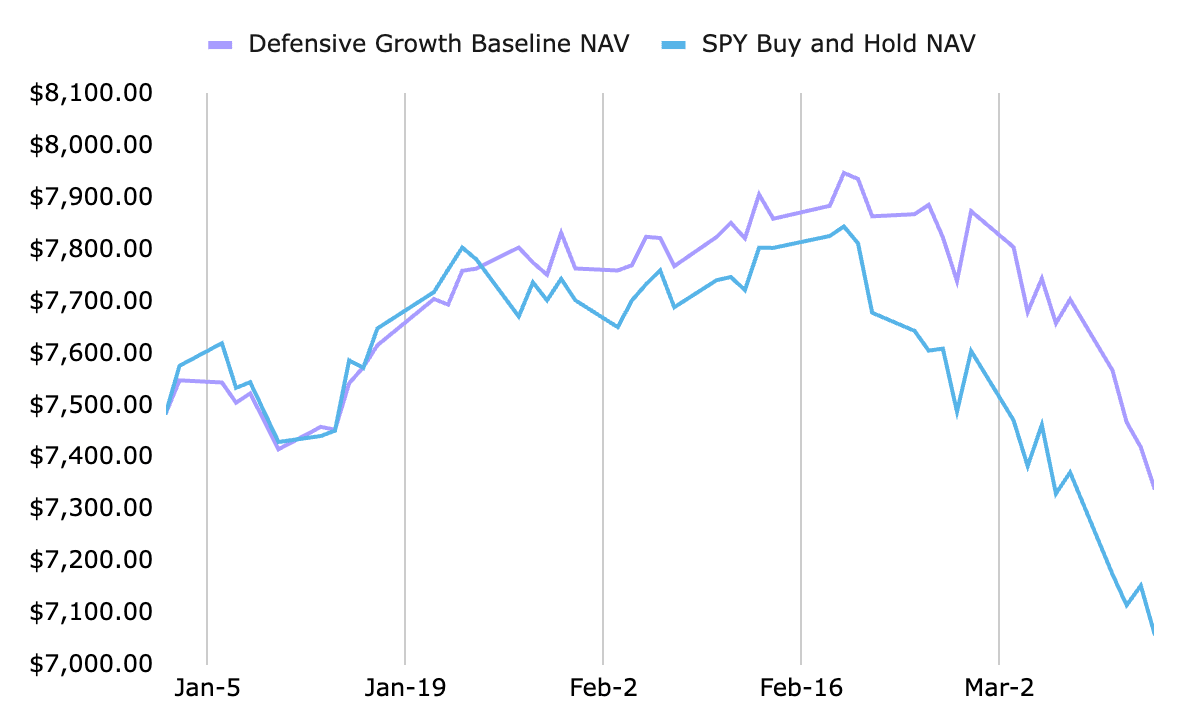

Defensive Growth Performance

Source: Arta Finance. Bloomberg. Pre-tax returns and performance charts shown are for the period between January 2, 2025 and March 13, 2025. These results are for a sample representative client account that has been operating since March 20th 2023, the strategy’s inception date. Net performance reflects the deduction of all fees and expenses that a client or investor has paid or would have paid in connection with the investment adviser's investment advisory services to the relevant portfolio, including advisory fees, trading costs, portfolio management, custody, and other administrative fees. All performance results are reported before taxes. Past performance does not guarantee future results, which may vary. The data shown is of a sample portfolio, is for informational purposes only and is not indicative of future portfolio characteristics or returns. Actual results may vary for each client due to specific client guidelines and other factors. The sample portfolio was chosen as most reflective of the strategy and specific guidelines provided by the client. Arta Finance does not provide accounting, tax or legal advice. The strategy is not expected to always outperform the S&P 500.

Pictured above are the year-to-date pre-tax performance charts of our Baseline Defensive Growth strategy (purple) against a SPY buy and hold strategy (blue) as of March 13th, 2025. During this period, our Baseline Defensive Growth strategy returned -1.93% after fees while SPY returned -5.68%. For more risk-averse investors, our Moderate Defensive Growth strategy is designed to provide even more protection against market turbulence, returning +1.73% after fees during the same period. Much of the outperformance for both strategies was driven by large allocations to consumer staples (XLP) and healthcare (XLV), which proved to be resilient against broader market declines.

Defensive Growth Performance Metrics, Net of Fees | YTD 1/1/25–3/13/25 | 1 year (Annualized) 3/14/24–3/13/25 | Since Inception (Annualized)* |

Defensive Growth - Moderate | 1.73% | 6.68% | 9.91% |

Defensive Growth - Baseline | -1.93% | 6.22% | 12.60% |

Defensive Growth - Elevated | -4.90% | 6.55% | 15.16% |

*Since inception returns for Defensive Growth - Moderate and Defensive Growth - Baseline are calculated from March 20, 2023. Since inception returns for Defensive Growth - Elevated are calculated from August 16, 2023.

The Power of Personalization

Arta simplifies investing by automatically managing risk and harvesting tax losses so you don’t have to lift a finger. But that doesn’t mean you can’t act on your own investment views. Many of Arta’s public equities products offer built-in personalization, allowing you to stay true to your investment beliefs, especially during periods of market volatility.

For example, you can:

Exclude specific stocks: Remove companies like TSLA or NVDA from your S&P 499 portfolio if you're concerned about their volatility.

Adjust portfolio tilts: Shift your Defensive Growth portfolio toward or away from certain industries—for instance, an investor wary of tech stocks can reduce their exposure to the technology sector.

Customize a satellite portfolio: Create a personalized portfolio aligned with your investment views and adjust its target allocation as needed.

At Arta, we focus on intelligent risk management and portfolio resilience to help investors navigate market uncertainty. Whether through defensive sector allocations or personalized portfolio adjustments, our proprietary strategies aim is to help investors stay on track for their goals and turn volatility into opportunity for long-term growth.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights