An open invitation—Arta is now available to all US accredited investors

October 18, 2023

Arta started 2 years ago with a mission to unlock the ‘financial superpowers’ of the ultra-wealthy and make them available to many more people. Earlier this year, we started inviting our first members and helping them set up their digital family office, a more tech-forward way to grow, protect and enjoy their wealth. After a few quarters of being in invite-only mode - we are excited to open up to all accredited investors in the US.

Why now?

Wealth management starts and ends with trust. We’re building a multi-generational company so our members and their families can rely on us for the long run. It also helps that the founders have significantly more experience (and as a result are a bit older with an average age of 47) and view this mission as their swansong. So we built this company differently from the average start-up.

Typically startups are pressured to release a “minimum viable product”. But there’s a lot at stake when it comes to managing people’s hard-earned assets. So we approached things a bit differently, by not only building a comprehensive offering but also a strong foundation that our members could trust. We wanted to hit three goals before we opened up more broadly:

$100M in assets - at this AUM, the SEC considers the advisor a large RIA;

A comprehensive product suite that could help our members grow, protect & enjoy their wealth; and

A community of early members who love Arta and can help us shape the company and product.

And while we’re in our early days compared to some of the 100+ year old private banks with trillions of dollars in assets, we are thrilled by the progress and the feedback so far. As we get started on our next stage of growth, here are some new features coming to Arta over the next few weeks.

Growing your wealth

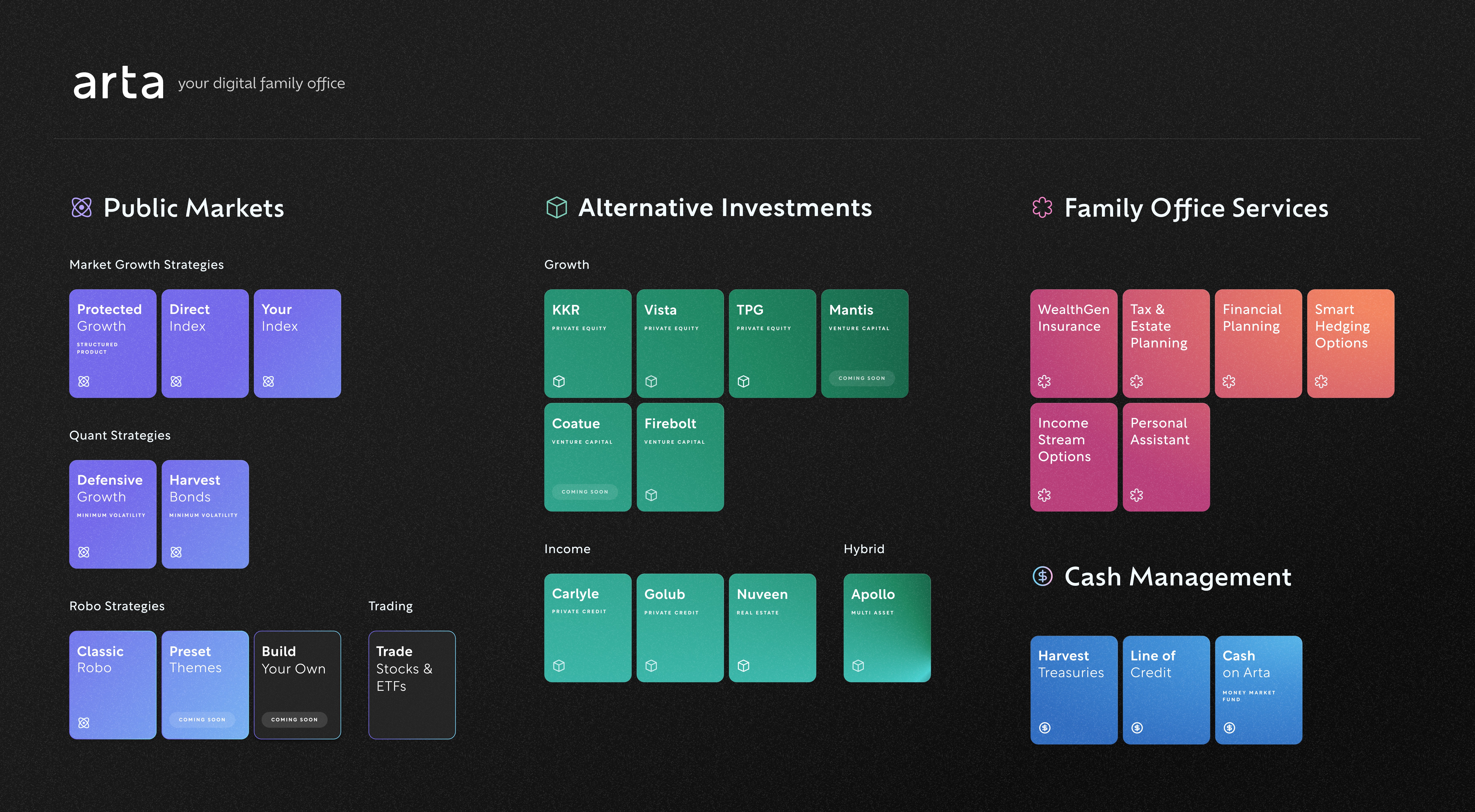

Public Markets

Arta launched with a keystone technology - uniting sophisticated quantitative investing techniques with machine learning and automated investing. But in the process, we also built an automated trading infrastructure to enable members to ride the public markets like the ultra-rich do. So over the next few weeks we’ll be launching a set of new capabilities that will enable our members to:

Go beyond investing in basic ETFs to setting up market tracking direct indexes with powerful tax-loss harvesting. Our members will also be able to better customize their investments by removing stocks where they already have significant holdings – for example, if you’re a Google employee who already owns a bunch of Google stock, you should really focus on S&P 499 to better diversify your portfolio.

Put every dollar to work using sophisticated cash management techniques - via High-Yield Cash Reserve or structured products like Principal Protected Growth.

And, for folks who just like vanilla, we’ll also offer a straightforward robo-advisor, but with tax loss harvesting and lower fees than you may expect, even from a robo.

Alternative Investments

Advice via a proprietary recommendation engine for asset allocation within alternative asset classes, helping our members choose the right investment mix for them according to their goals, risk preferences, and liquidity needs.

New Alternative Investments from hard-to-access asset managers like Vista, TPG, Carlyle, Golub, Coatue, Mantis VC, and many more in the pipeline.

Protecting your wealth

Initially, Arta has focused on a few areas to help members to protect their hard-earned money for future generations, rising inflation, or simply against market uncertainty.

WealthGen Insurance is a tax-advantaged permanent life policy that protects your loved ones while creating a growing asset. This is how the ultrawealthy use insurance – as a tax-advantaged investment vehicle similar to a Roth IRA, but even more powerful. WealthGen insurance has emerged as one of our most popular products with members having set up nearly $40M in policies through Arta. WealthGen Insurance is now expanding to include alternative investments to better accommodate the diverse needs of Arta’s members.

Managing overconcentration risk. Many of Arta’s members have accumulated stock from their employers, usually concentrated in a single company or industry such as tech. Options and derivatives can provide downside protection or income while waiting for a desired sale price, helping members diversify out of their concentrated position. Arta has made it easy to deploy these advanced strategies responsibly and safely, with just a few simple steps.

Structured investments to gain a majority of market upside while protecting against market downside. Structured products – typically a customized combination of equities, bonds and derivatives – are used by wealthy investors to protect against certain market conditions while still participating in market upside. The thing is, they’re usually only available at high minimums and high fees. That’s where we come in. Our first structured product, Principal Protected Growth (“PPG”), is now open and provides market upside with no loss of principal in case of a market downturn1.

We’re adding two important areas:

Tax and estate planning is often relegated to the “important, not urgent” bucket. Arta brings this up higher in your priorities by making it easier to connect with a specialist in the field – helping you structure your affairs and efficiently pay taxes so you can maximize your estate for your loved ones and avoid estate planning blindspots.

Financial Planning. Some of our early members told us they want more advice and guidance on the investment allocation process. That’s why we’re now starting to offer financial planning services to Arta members, to assist in crafting a financial game plan that suits their unique situations.

Enjoying your wealth

As we move further along in our own personal financial journeys, we are continually reminded that true wealth is achieved when you have time and expertise to enjoy it.

That’s why we’re investing in two key areas:

Helping members take their time back by providing personal assistant services.

Facilitating opportunities to connect both online and in person with other Arta members so they can learn, benchmark, and get inspired from each other.

Thank you to Arta's earliest members

Early members have sent us hours of feedback, helped us gain insight into their financial goals, and invited other members into the fold. As we had guessed, many of our members are looking towards us for an intuitive and personalized experience, a holistic approach to their assets, access to the same opportunities as the ultra-wealthy, and a digital-native ethos that they’ve come to expect from the other essential services in their lives. As our member circle has grown beyond our friends and ex-colleagues, we’re encouraged by their reaffirmation that Arta is on the right track.

We couldn’t be more grateful to Arta’s extended community - our investors, partners, and members – who have entrusted us to be part of their financial future. Arta is now open to accredited investors in the United States – and we’re working to expand this to millions more globally over time. We look forward to welcoming you as an Arta member!

Footnotes

- PPG offers protection of your principal, however, investors do have counterparty risk where, like any corporate bond, your principal is subject to the credit risk of the issuing bank. Arta only partners with investment-grade issuers, as determined by the major credit rating agencies. See disclosures here.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights