Private Placement Life Insurance: A Vehicle for Tax-Efficient Investing

June 12, 2024

Imagine an investment strategy that not only offers flexibility and tax benefits but also helps you leave a meaningful legacy for your loved ones.

If that piqued your interest, hear us out. We understand that insurance can seem complex (and a bit dry), but understanding some of the less-known ways to use it can be a potential game-changer for your portfolio.

High-net-worth individuals and family offices have increasingly turned to Private Placement Life Insurance (PPLI), a tax-efficient investing vehicle, since the 1990s. While historically lofty minimums made PPLI inaccessible for most Americans, you don't need to be a billionaire to benefit from this structure today.

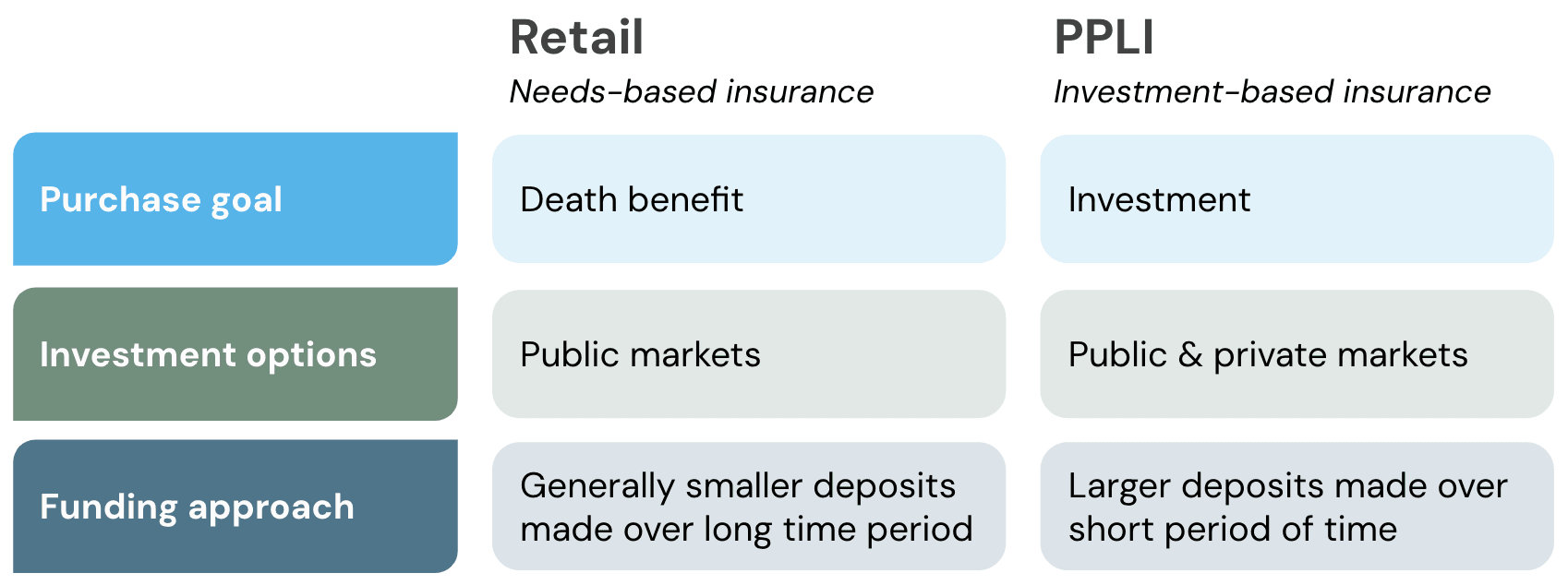

Many choose PPLI for its tax perks and investment flexibility. Unlike most life insurance policies, PPLI is designed to minimize insurance costs and maximize investment growth in its tax-advantaged 'cash value' account. This makes it a compelling option for those seeking to invest in tax-inefficient assets, such as alternatives, while potentially minimizing their tax burden on investment gains.

What is Private Placement Life Insurance?

Private Placement Life Insurance (PPLI) is a type of life insurance policy available to qualified purchasers (those with a net worth over $5 million, excluding their primary residence). PPLI policies are customized, flexible, and tailored to the unique needs of each policyholder – hence why they’re called “private.”

PPLI policies, like traditional forms of permanent life insurance, can offer notable tax advantages, making them an attractive wealth preservation tool.

Earnings within the policy grow tax-deferred like an IRA, allowing for tax-free compounding of even the most tax-inefficient assets.

Buys, Sells, and Transfers among investments within the policy are not taxed at the time of the transaction.

Income (loans or withdrawals from the policy) can generally be tax-free, if appropriately structured.

The payout to your loved one when you pass on is generally not subject to income tax, and if held in an irrevocable trust, may not be subject to estate tax.

Due to their flexible nature, PPLI policies are generally structured to minimize the “insurance” portion of the policy and maximize the “investment” portion, allocating most of the premium to a tax-advantaged investment account called “cash value”.

How is it different from other permanent life insurance?

One of the main features of PPLI is that it allows for a wide range of investment options, including hedge funds, private equity funds, and other alternative investments that are generally highly tax-inefficient and not typically available in traditional life insurance policies. Additionally, due to its tax-advantaged status, no K-1s are required from underlying investments.

Additionally, PPLI's advantage over retail life insurance is its lower, transparent, institutional pricing. Whereas retail insurance products such as whole life and universal life have higher costs and may lack transparency, PPLI is priced and structured like an investment. Fees and costs are clearly listed, and, unlike most retail insurance products, PPLI policies generally do not carry surrender charges or penalties.

Is PPLI only for billionaires?

No—the benefits of a PPLI can apply to many affluent people.

Generally, PPLI is appropriate for those who:

Are looking to make a total investment over time of at least $1 million

Are seeking a solution to grow assets tax free and have already maximized other tax-advantaged opportunities

Invest in alternatives or other tax-inefficient assets

Live in a state with a high income tax and/or are subject to a total marginal tax rate above 30%

What are the steps involved in getting a PPLI policy?

We’re able to guide you through every step of the process to set up a PPLI policy:

Talk to a licensed insurance expert, like the ones at Arta, about your financial goals.

Determine appropriate sizing.

Select an insurance carrier and customize the PPLI policy as appropriate.

Undergo medical underwriting.

Decide on the owner of the policy. This is often the individual or an entity, such as an irrevocable trust. Arta can help with this too!

Choose your investments–either pre-approved funds from the insurer or appoint an insurer-approved investment manager (including Arta).

Few financial institutions are set up to offer both insurance along with investment advice and services for PPLI. As a digital family office, Arta Finance can help on both of those fronts–partnering with over 30 national insurers to find the best policy to meet each member’s needs.

Schedule time with one of our insurance experts at Arta to learn more about PPLI and if it could be right for you.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights