Thinking in Private Equity Investment Cycles: A Pragmatic Approach to Wealth Growth

December 15, 2023

Around here, we think of private equity (PE) as a path less traveled that holds the promise of substantial rewards.

For some folks, the idea of locking up your funds for a 10-year cycle might seem daunting. It's like burying a time capsule and waiting eagerly to unearth it. But when you shift your perspective and view PE funds through the lens of long-term investment cycles, the picture starts to change – and exciting possibilities emerge.

A look back to leap forward

Rewind to 2004. Imagine if someone told you about a social network that would grow from obscurity to nearly 3 billion users. Or a young songwriter who would eventually create a $10B economic wave with her “Eras” tour. And Tom Brady? Back then, his now-legendary career and seven Super Bowl wins were still unfolding.

The point is that predicting the future is hard! But the power of compounding investment isn't.

The “magic” of compounding

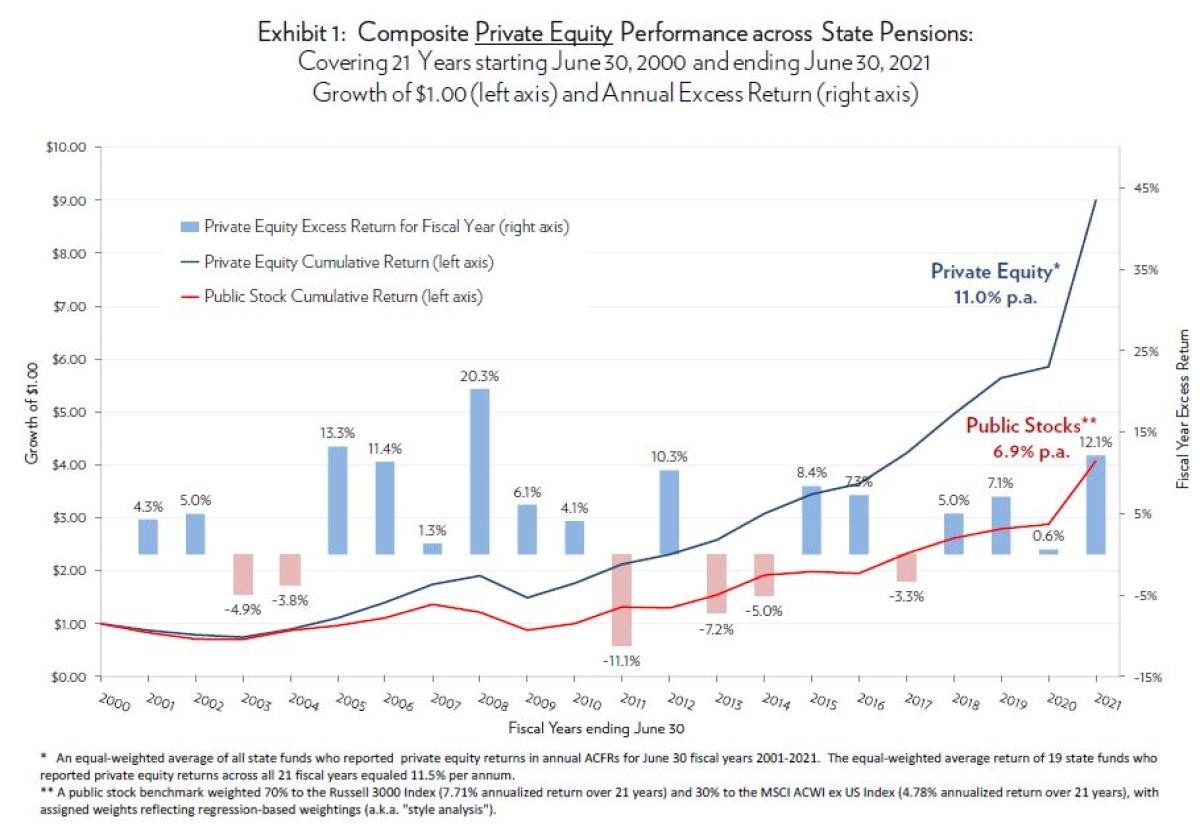

According to CAIA, over a 21-year period ending June 30, 2021, state pensions earned an annual return of 11.0% by investing in private equity. Public stocks came in at a 6.9% annualized return. This difference in returns is stark. But thanks to compounding, the difference gets further magnified; private equity nearly doubled their gains over a 10-year period (from 2011-2021) compared to public stocks.

Source: Long-Term Private Equity Performance: 2000 - 2021, CAIA

Here’s some more good news.

When it comes to private equity, thinking about it with a 10-year investment window is more than just a timeframe – it's an opportunity. Here’s why:

Higher Potential Returns: Given the extended investment period and the tendency to "go deep" in an asset class, private equity fund managers offer returns that can outpace other investment classes by double or triple.

Diversification: Private market assets typically dance to their own tune (maybe to Taylor Swift songs), independent of the public markets. This "low correlation" means they can add variety and balance to your portfolio.

Long-term Discipline: Investing with a 10-year horizon instills a sense of discipline and strategic planning in your financial plan. It's no wonder many ultra-high-net-worth families allocate ⅓ or more of their portfolios to private market assets.

Think about the future in fund cycles

Fast forward 20 years, or two PE fund cycles. That’s a period marked by life-changing events, from watching your child go from cradle to college, building your career through to retiring, and experiencing countless other adventures. Viewing your investment strategy in terms of fund cycles isn’t just smart; it’s a pathway to potentially lucrative outcomes.

Your Next Steps

As you think about the next couple of decades and what you’re trying to achieve, let us know if we can help. Our alternative investments team is available to meet with you 1:1 if you’d like to take a deeper dive into alternative investments and how to work them into your overall portfolio. Feel free to schedule time with the team directly using this link and we’ll help you out. Your journey to long-term investment success, whether it be in PE fund cycles or otherwise, starts here.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights