TL;DR Direct indexing is a portfolio management strategy that lets you customize your investments and minimize taxes by holding individual stocks. Direct indexing portfolios can generate capital losses, which occur when you sell a stock for less than you paid for it. These losses matter because they can offset realized gains from other investments, reducing your overall tax bill. Over time, these tax benefits can add up, with the goal of exceeding the costs of managing the portfolio.

Overall, direct indexing offers a personalized approach to investing, maximizing tax benefits and aligning investments with individual financial goals and values.

What is direct indexing?

Direct indexing is a savvy portfolio management strategy where investors choose an index, like the S&P 500, and portfolio managers buy a selection of individual stocks to closely mirror the index's performance and risk.

This approach offers significant advantages. By holding individual stocks, investors have the flexibility to customize their portfolios to align with their specific goals and preferences. Whether you want to exclude certain industries, emphasize particular sectors, or adhere to ESG principles, direct indexing allows you to tailor your investments precisely.

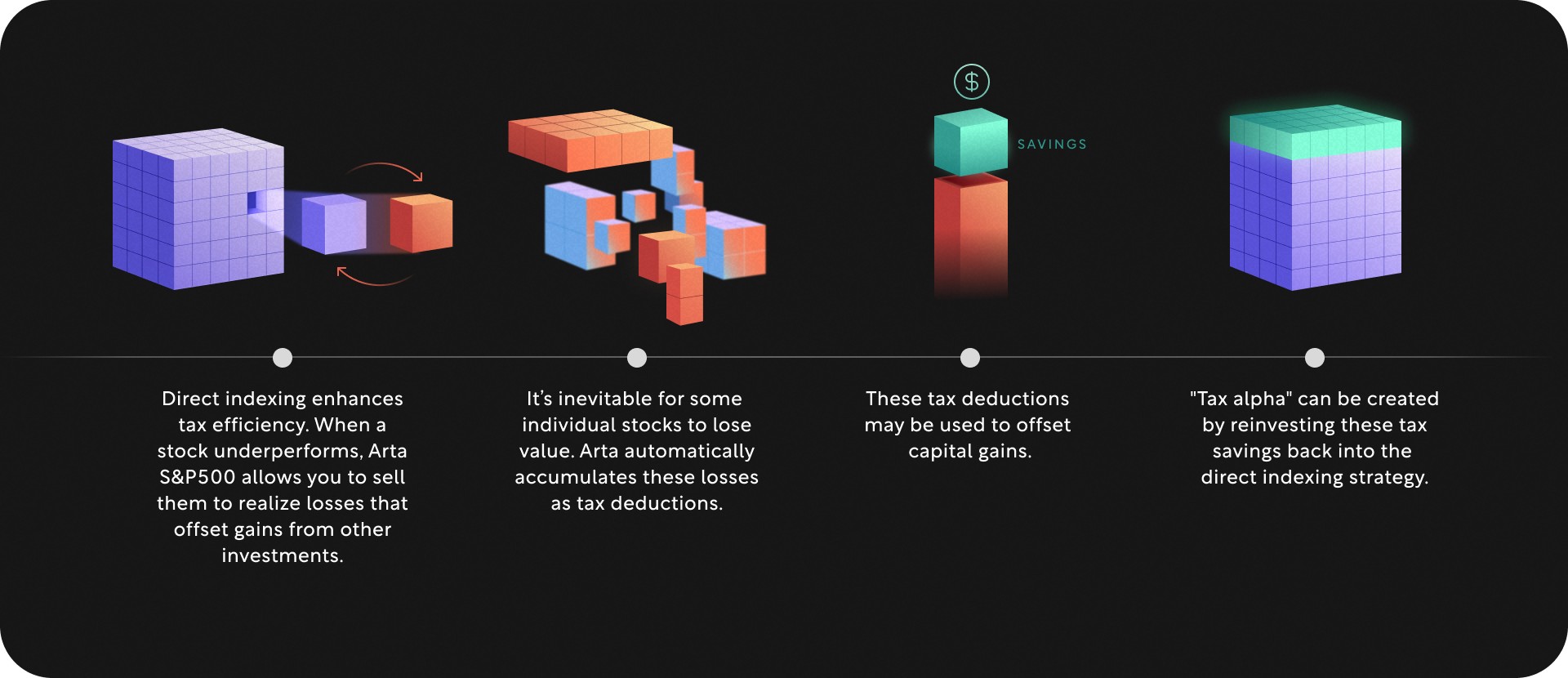

Furthermore, direct indexing enhances tax efficiency. Unlike traditional ETFs, which treat all investors the same, direct indexing lets you manage capital gains and losses more strategically. When individual stocks underperform, you can sell them to realize losses that offset gains from other investments, reducing your overall tax burden. Over time, these tax savings can compound, with the aim of outweighing the costs of managing the portfolio.

In short, direct indexing not only lets you build a portfolio that matches your values and objectives but also helps you keep more of your returns by optimizing for tax efficiency.

Why choose direct indexing?

Direct indexing offers two major advantages over a similar index ETF:

Tax alpha generation: Tax alpha refers to the extra after-tax returns generated through strategic tax management, which you don’t get with standard index funds. This is a standout benefit of direct indexing. By harvesting losses from individual stocks, especially in volatile markets, you can offset gains and significantly reduce your tax bill. Over time, these tax benefits can compound, potentially covering most, if not all, of the portfolio management costs.

Portfolio customization: Direct indexing allows for unparalleled customization. For example, if you or your spouse have a significant position in Google stock from years of restricted stock unit vesting, you can exclude Google from your direct indexing portfolio to avoid further exposure to its stock performance. This flexibility lets you tailor your investments to fit your specific financial situation, goals, and values. To sum things up, direct indexing not only enhances tax efficiency and portfolio customization but also empowers you with direct ownership of shares, giving you greater control and alignment with your financial goals and personal values.

When does direct indexing make sense?

Direct indexing offers the most value to investors who:

1. Are in the highest tax brackets: When you’re in the highest tax brackets, realizing capital gains can result in a hefty tax bill. For instance, investors in states like California, New York, and New Jersey could end up paying over 50% on short-term capital gains. See the table below. This is where tax-loss harvesting becomes incredibly valuable. By deferring these taxes, you effectively reduce your immediate tax burden. Jack Bogle, the founder of Vanguard, famously said that tax deferral is like getting a free loan from the government. By using tax-loss harvesting to offset gains, you can keep more of your money working for you, instead of handing it over to the taxman.

California | Federal | State | NIIT | Total |

Short | 37.00% | 13.30% | 3.80% | 54.10% |

Long | 20.00% | 13.30% | 3.80% | 37.10% |

New York | Federal | State | NIIT | Total |

Short | 37.00% | 10.90% | 3.80% | 51.70% |

Long | 20.00% | 10.90% | 3.80% | 34.70% |

New Jersey | Federal | State | NIIT | Total |

Short | 37.00% | 10.75% | 3.80% | 51.55% |

Long | 20.00% | 10.75% | 3.80% | 34.55% |

Notes on tax brackets:

At the federal level, short-term capital gains are taxed at ordinary income rates. Long-term capital gains have distinct brackets and tend to be taxed at preferential rates. Both sets of brackets can be viewed here. The Net Investment Income Tax (NIIT) applies to anyone with net investment income and modified adjusted gross income over certain thresholds listed here. California, New York, and New Jersey are examples of states treating short-term capital gains and long-term capital gains as income. Tax Foundation provides a helpful visual for comparing state tax rates. The Tax Cuts and Jobs Act of 2017 capped the state and local tax (SALT) itemized income tax deduction at $10,000 for married couples. We assume the cap is negligible in the summed rates above. If the SALT cap expires as scheduled after 2025, all else equal, this likely reduces the total federal tax burden calculated above. Lastly, summing the highest marginal tax rates and NIIT considers incremental dollars taxed at these rates, not those taxed in lower brackets.

2. Portfolio customization: Investors with large positions in certain stocks can benefit from excluding those stocks from their direct indexing portfolio. This is particularly useful for avoiding overexposure to specific companies. Beyond that, direct indexing lets you tailor your investments to match your personal priorities and beliefs. Whether you want to focus on ESG factors, exclude certain industries, or emphasize particular sectors, direct indexing allows you to create a custom index that aligns with your unique requirements.

3. Discipline and automation: Direct indexing promotes disciplined investing by automatically rebalancing your portfolio. This strategy follows a contrarian approach, selling stocks that have appreciated and buying those that are potentially undervalued. This automated, emotion-free process helps you stick to your investment strategy without the pitfalls of emotional decision-making. Research shows that this kind of dispassionate investing often performs better over the long run, ensuring your portfolio remains balanced and aligned with your goals.

Direct indexing is a collection of tax strategies

Direct indexing is a game-changer because it allows you to hold individual stocks, giving you greater control over your tax strategies. This control can significantly boost your after-tax returns. The essence of a good tax strategy often comes down to timing—accelerating losses and deferring gains. With direct indexing, you have the flexibility to do both. This means you can strategically sell underperforming stocks to harvest losses when it’s most advantageous and defer selling winners to minimize your tax burden, maximizing your investment's potential.

Direct indexing can automate the following tax strategies:

Holding period management: One of the most basic yet effective tax strategies is managing the holding period of your investments. The idea is to defer realizing capital gains until your holdings qualify as long-term investments. In the United States, this means you need to hold each individual tax lot—essentially the shares you vested or purchased in a single transaction—for more than one year. Once you pass this one-year mark, your gains are taxed at the lower long-term capital gains rate, significantly reducing your tax burden and increasing your after-tax returns.

Specified lot selection: A tax lot is a record of when and at what price a security was acquired. This can include various transactions, such as multiple RSUs vesting at different prices or a series of order fills for a large trade. Managing individual tax lots is a major benefit of algorithm-driven portfolio management. With direct indexing, you can precisely select which tax lots to sell to minimize your tax liability on any given trade. Arta monitors these tax lots so they are kept in sync with the securities custodian and also maintains its own records for added accuracy and security. This meticulous approach helps you maximize tax efficiency and keep your investment strategy on track.

Tax-loss harvesting: Tax-loss harvesting is a strategy that turns a decline in share price into a valuable opportunity. When a stock in your direct indexing portfolio loses value, you can sell it (or “harvest a loss”) and replace it with another stock that has similar risk exposure or is underrepresented in your portfolio. This harvested loss can then be used to offset capital gains, reducing your overall tax bill. The benefits of tax-loss harvesting can significantly boost your portfolio’s value and compound over time. Studies by independent industry and academic researchers consistently show that tax-loss harvesting can add around 100 basis points in annual tax alpha to your returns (see sources below).

Wash sale management: Investors need to be mindful of the Wash Sale Rule, which prohibits purchasing “substantially identical” shares within 30 days before or after selling at a loss—a 61-day window. If triggered, this rule delays when you can utilize your harvested losses, which can impact your long-term tax savings. In some cases, such as purchases within an IRA, the loss is permanently disallowed. This rule is particularly relevant for employees compensated with company stock. For example, if a Meta Platforms, Inc. employee sells META shares at a loss to capture the tax benefit but then receives additional META shares within 30 days, a wash sale is triggered, and the tax benefit is postponed. Direct indexing helps navigate this by allowing you to exclude specific stocks, like META, from your portfolio, avoiding the wash sale complication. By effectively managing the Wash Sale Rule, you preserve the immediate tax benefits of harvesting losses, which compound over time and contribute to your long-term after-tax growth.

Should I just buy an ETF?

There are two key features in direct indexing that an ETF cannot match:

Portfolio customization: Direct indexing offers a level of customization that ETFs simply can’t match. With direct indexing, you can include or exclude individual stocks based on your specific needs and preferences. This is especially beneficial for couples both working in a similar sector who may want to exclude their employer’s stock from their investments to avoid overexposure. In contrast, investing in ETFs means buying a pre-packaged product designed for broad appeal. You don’t have the flexibility to tailor it to your unique situation. Direct indexing empowers you to create a truly personalized portfolio, aligned with your financial goals and values.

Passing through tax losses: Direct indexing portfolios excel at harvesting tax losses to generate tax alpha, which compounds over time. While many people know that ETFs can also harvest tax losses, the key difference is how these losses are handled. Direct indexing portfolios pass the harvested losses back to you, allowing you to offset capital gains from other investments or up to $3,000 in ordinary income. In contrast, ETF-harvested losses remain within the ETF and aren’t passed through to investors. You might think, “Why not just sell the entire ETF to harvest losses?” While that’s possible, holding individual stocks through direct indexing offers a unique advantage: you can harvest losses even when the overall market is up. Vanguard research shows that every year since 1993, a portion of stocks in the S&P 500 had negative returns. A direct indexing portfolio captures these individual losses, whereas an ETF might not. Now, you may be concerned about the cost, thinking, “But direct indexing is more expensive than an ETF.” While that’s true, the tax alpha generated from harvesting and passing through tax losses can often more than cover these additional costs. Research from Aperio indicates that direct indexing with tax-loss harvesting can add over 100 basis points of tax alpha, significantly enhancing your after-tax returns compared to an ETF.

Can I do direct indexing with tax-loss harvesting on my own?

Managing direct indexing and tax-loss harvesting on your own can be challenging. It involves managing dozens of investor and risk constraints. The portfolio is investing, harvesting losses, and rebalancing across potentially hundreds of individual stocks. This means you might have to monitor thousands of tax lots, which can quickly become overwhelming.

The complexity is so high that advanced portfolio management algorithms are often used. These algorithms incorporate specialized mean-variance solvers to balance portfolio risk while taking into account all constraints, tax lots, tax rules, and risk parameters.

For a deeper dive into why automating tax-loss harvesting makes sense, check out this article. Automating this process can save you time, reduce errors, and help you maximize your tax benefits.

Maximize your investment potential with direct indexing and tax-loss harvesting

Direct indexing, combined with the power of tax-loss harvesting, is a powerful strategy for investors looking to minimize the tax impact on their investment income. By enabling greater tax efficiency and customization, direct indexing can significantly enhance after-tax investment performance. This approach is particularly attractive for investors in high-income tax brackets or those with specific investment preferences, offering a tailored and tax-smart way to manage your portfolio.

Experience effortless customization and tax savings with Arta

Arta simplifies direct indexing, making it as easy as buying an ETF. As a member, you'll enjoy all the tax and customization benefits of direct indexing, plus access to a wide range of other investment opportunities. Everything is seamlessly integrated into a holistic portfolio view, ensuring that your investment strategy is both comprehensive and personalized.

Let Arta help you grow a portfolio that’s as unique and dynamic as you are. Head over to Arta to check out Direct Indexing. Or, if you prefer a personal touch, schedule some time with our member success team. Either way, we look forward to helping you get started.

Sources

Dickson, Joel M., and John B. Shoven. 1994. “A Stock Index Mutual Fund Without Net Capital Gains Realizations.” SSRN Scholarly Paper. Rochester, NY. https://papers.ssrn.com/abstract=5427.

Khang, Kevin, Thomas Paradise, and Joel Dickson. 2020. “Tax Loss Harvesting: A Portfolio and Wealth Planning Perspective.”

Chaudhuri, Shomesh E., Terence C. Burnham, and Andrew W. Lo. 2020. “An Empirical Evaluation of Tax-Loss-Harvesting Alpha.” Financial Analysts Journal 76 (3): 99–108. https://doi.org/10.1080/0015198X.2020.1760064.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights