Education

Arta Presents: AI-Managed Portfolios

Education

July 25, 2023

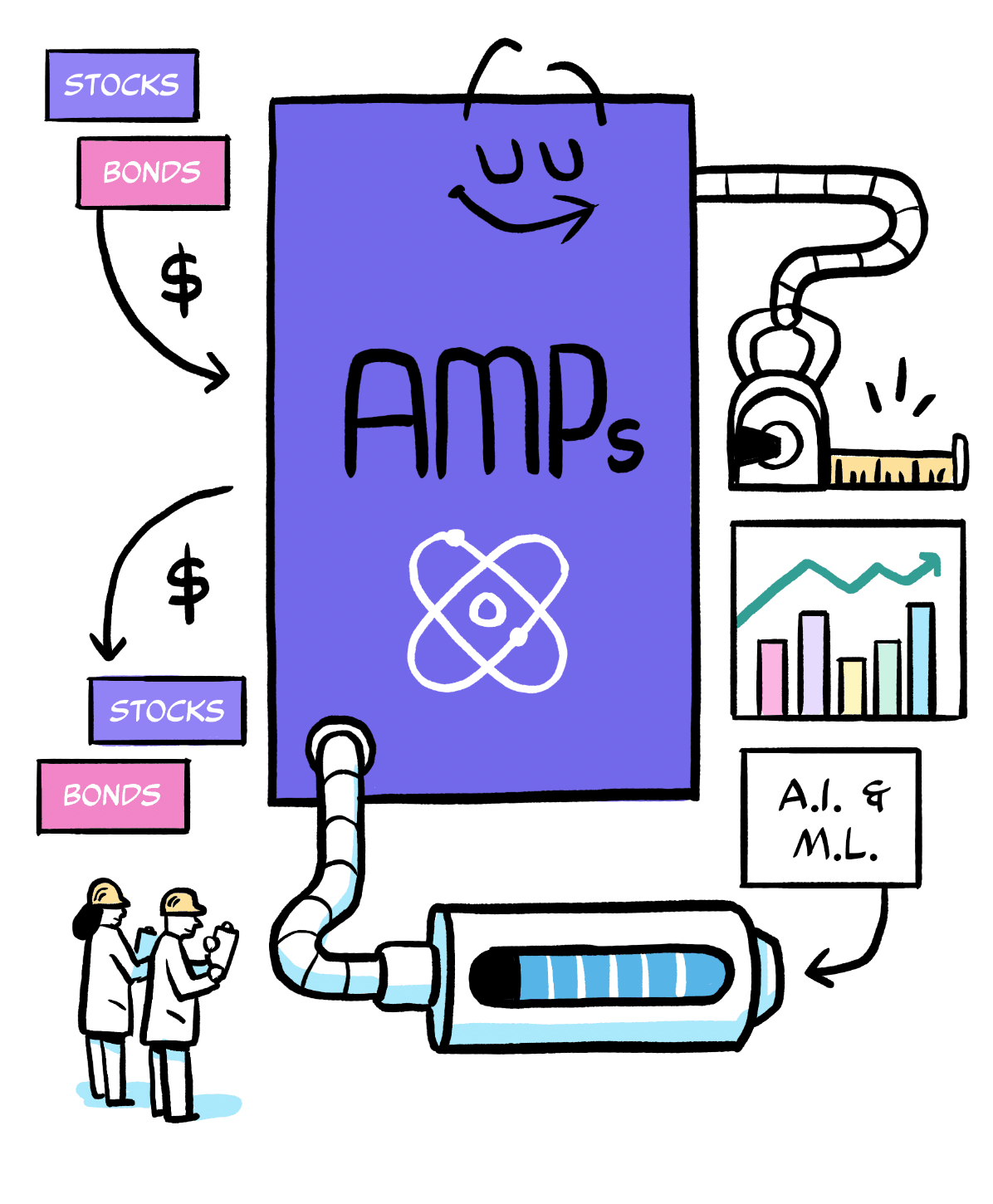

Meet our A.I. Powered Portfolios — or “AMPs” as we like to call them.

What is an AMP?

AMPs are tech-powered investment portfolios that evolve to help achieve your financial goals and adapt to changing market conditions — kinda like your personalized quant hedge fund.

What do AMPs do?

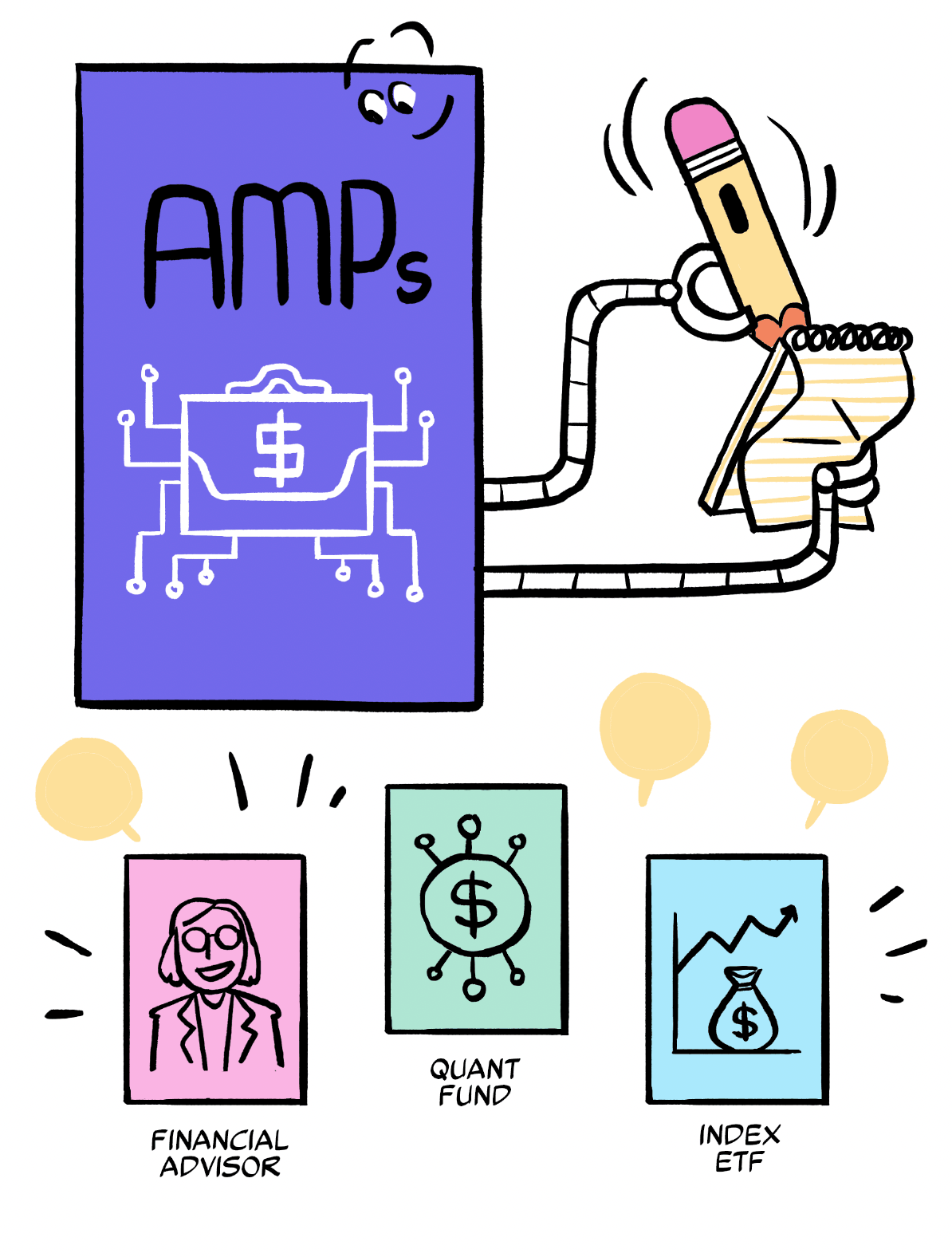

AMPs aim to deliver better risk-adjusted returns by bringing artificial intelligence expertise together with:

The personalization you’d expect from a dedicated financial advisor

The performance from the tech-driven methods used by quant funds

The simplicity and low price of passive investments like an ETF of Robo advisor.

Why should I care?

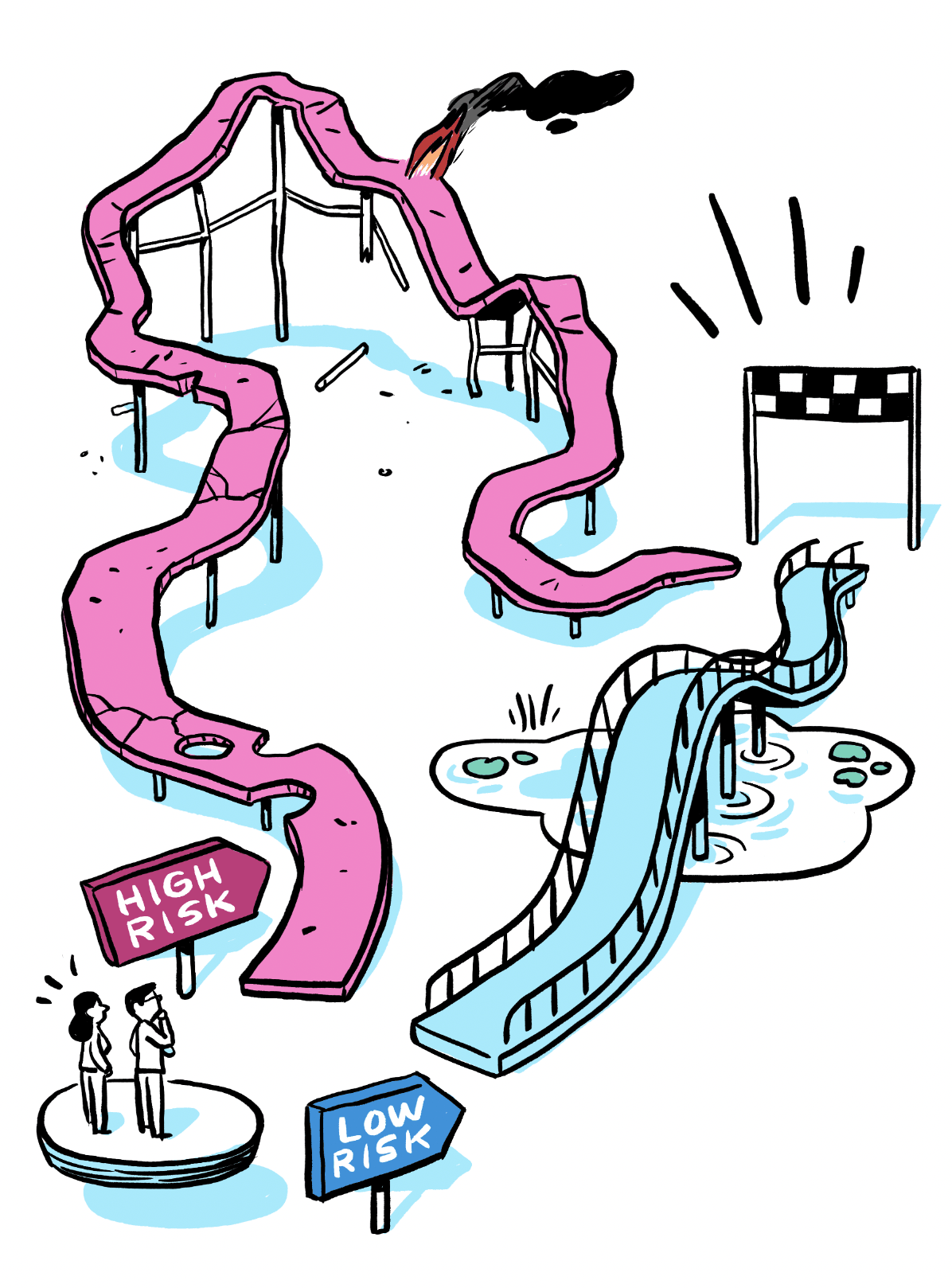

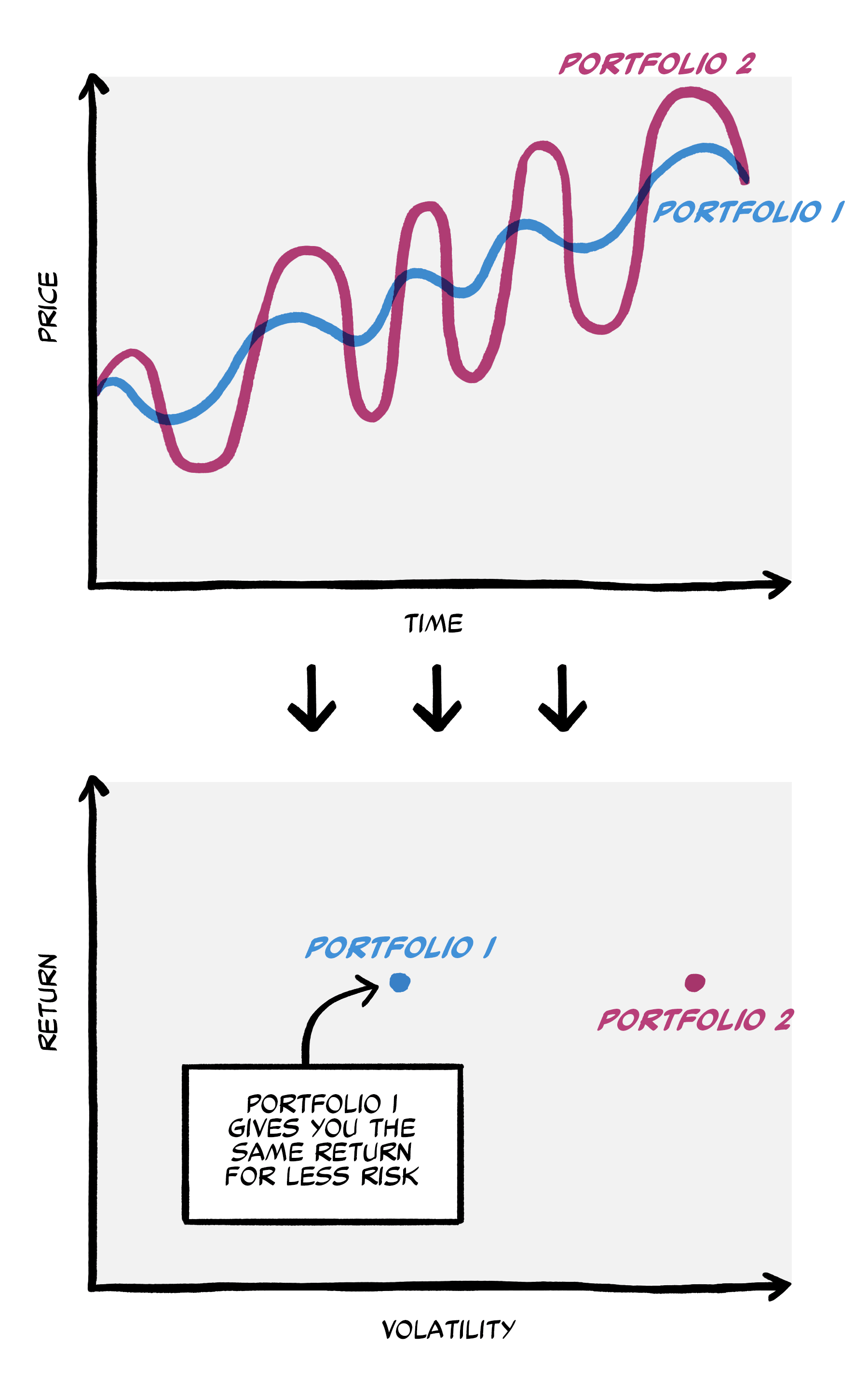

We look at risk-adjusted returns because just looking at returns without accounting for the associated risk would be like traveling to a destination without considering the path to get there.

You need to consider both the return and the risk dimension. AMPs are tuned to aim for highest possible performance over the long-term, at a level of risk that the member is comfortable with.

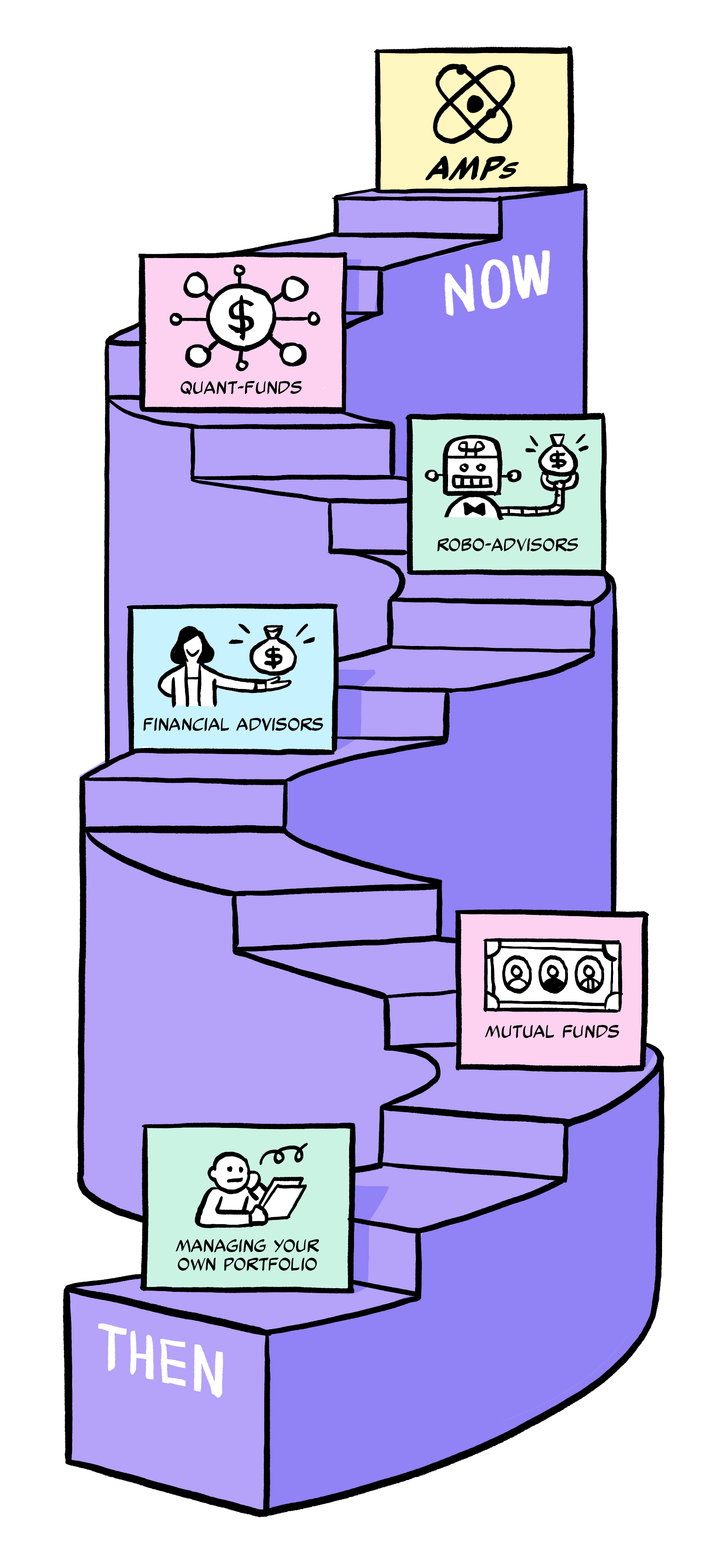

AMPs are a new-era innovation in optimizing public market investments.

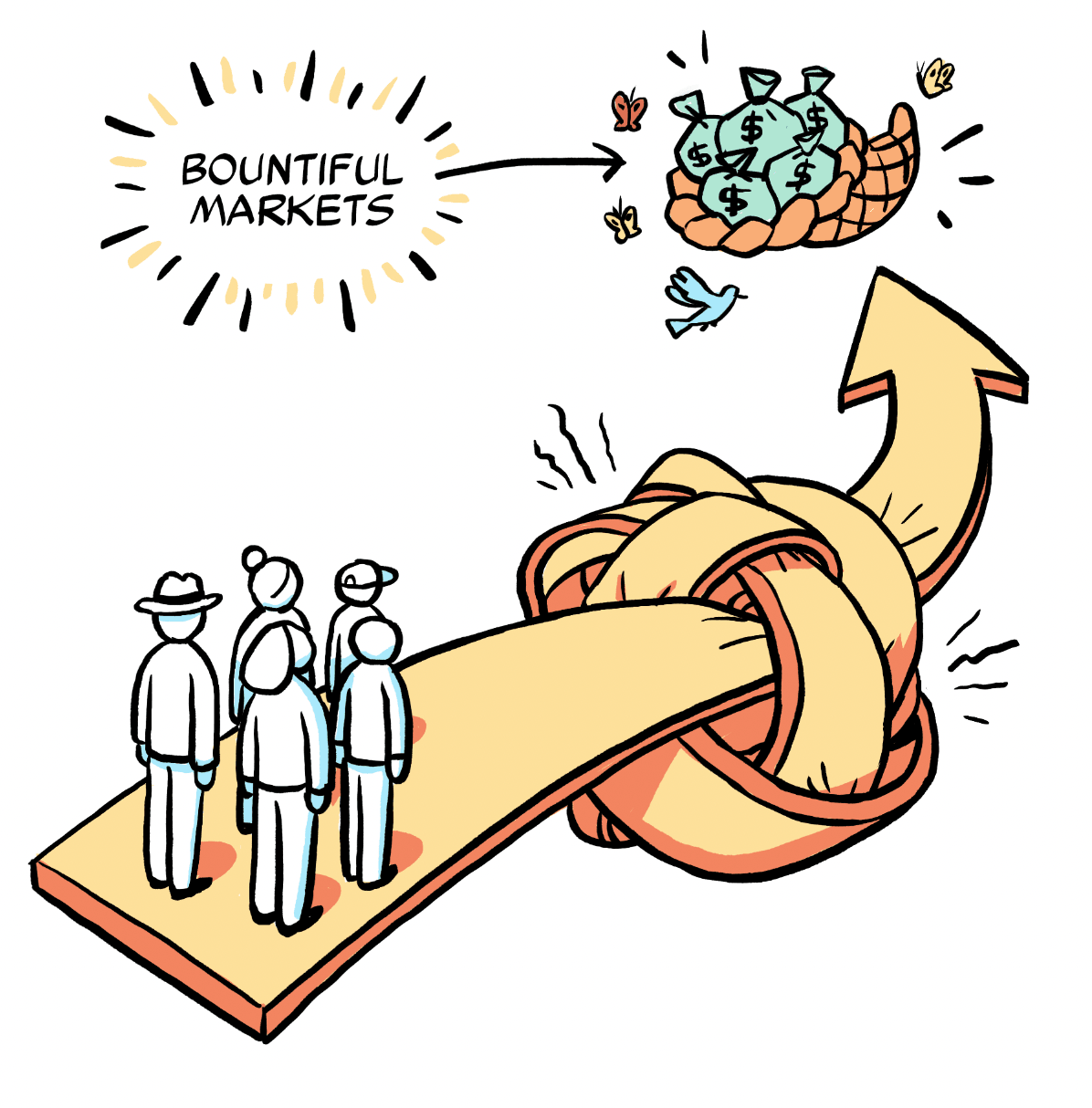

Public markets are an important generator of long-term wealth, and we believe more people should be investing in stocks, bonds, ETFs, options, and other public market assets to achieve their financial goals.

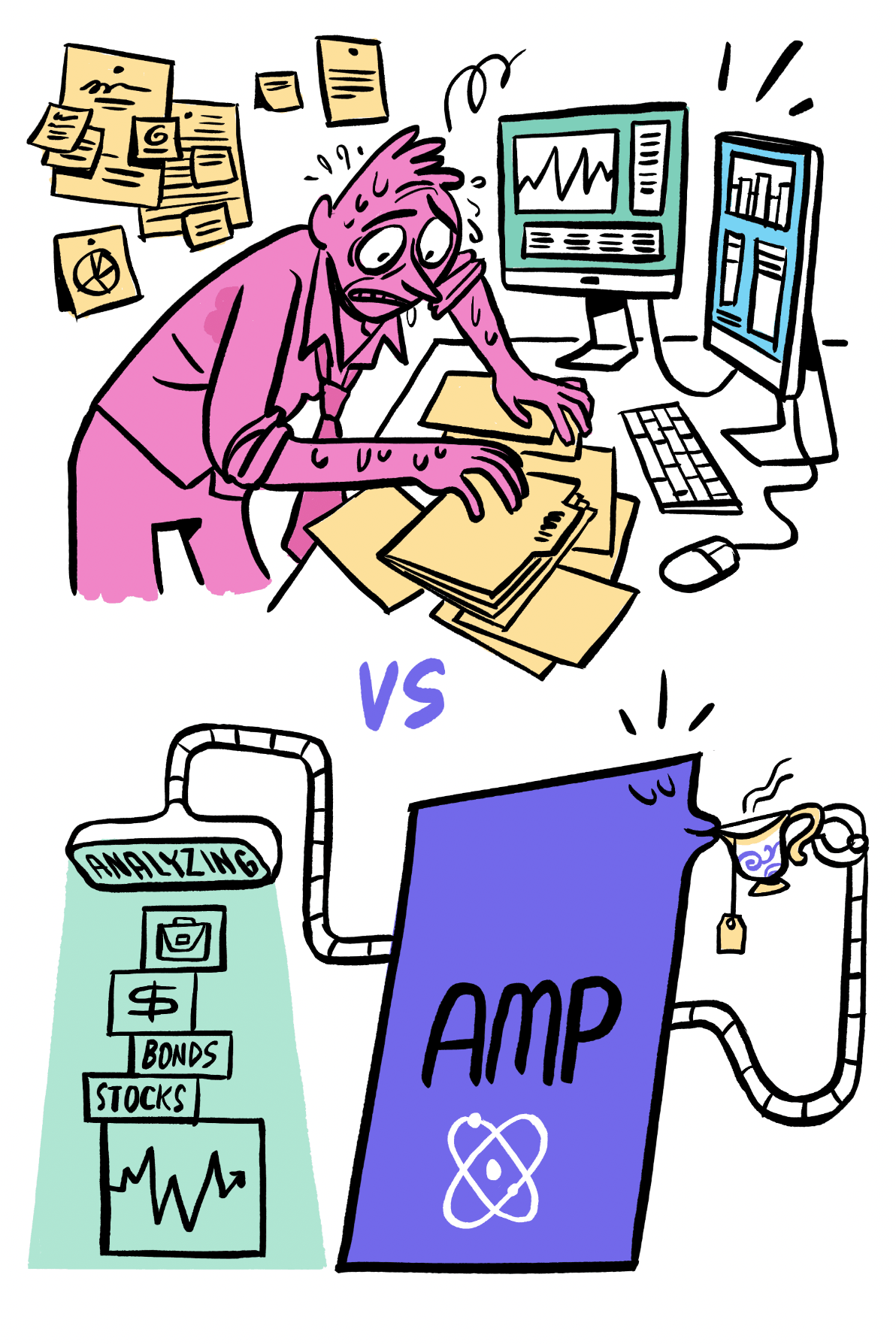

However, the creation and management of an investment portfolio is a morass of compromises.

Generally, people can choose to either do it all themselves, pay high fees for something customized, or buy something generic and underperforming at a lower cost.

We built AMPs because advances in AI have finally made it possible for everyone to have access to the sophisticated portfolio management techniques that are often used by the ultra-wealthy.

How do AMPs work?

AMPs are based on a combination of well-established investment research methodologies and scientific rigor from the quant fund world. They bring together decades of peer-reviewed investment research with cutting-edge AI that aim to deliver better risk-adjusted returns, while keeping fees low and transparent.

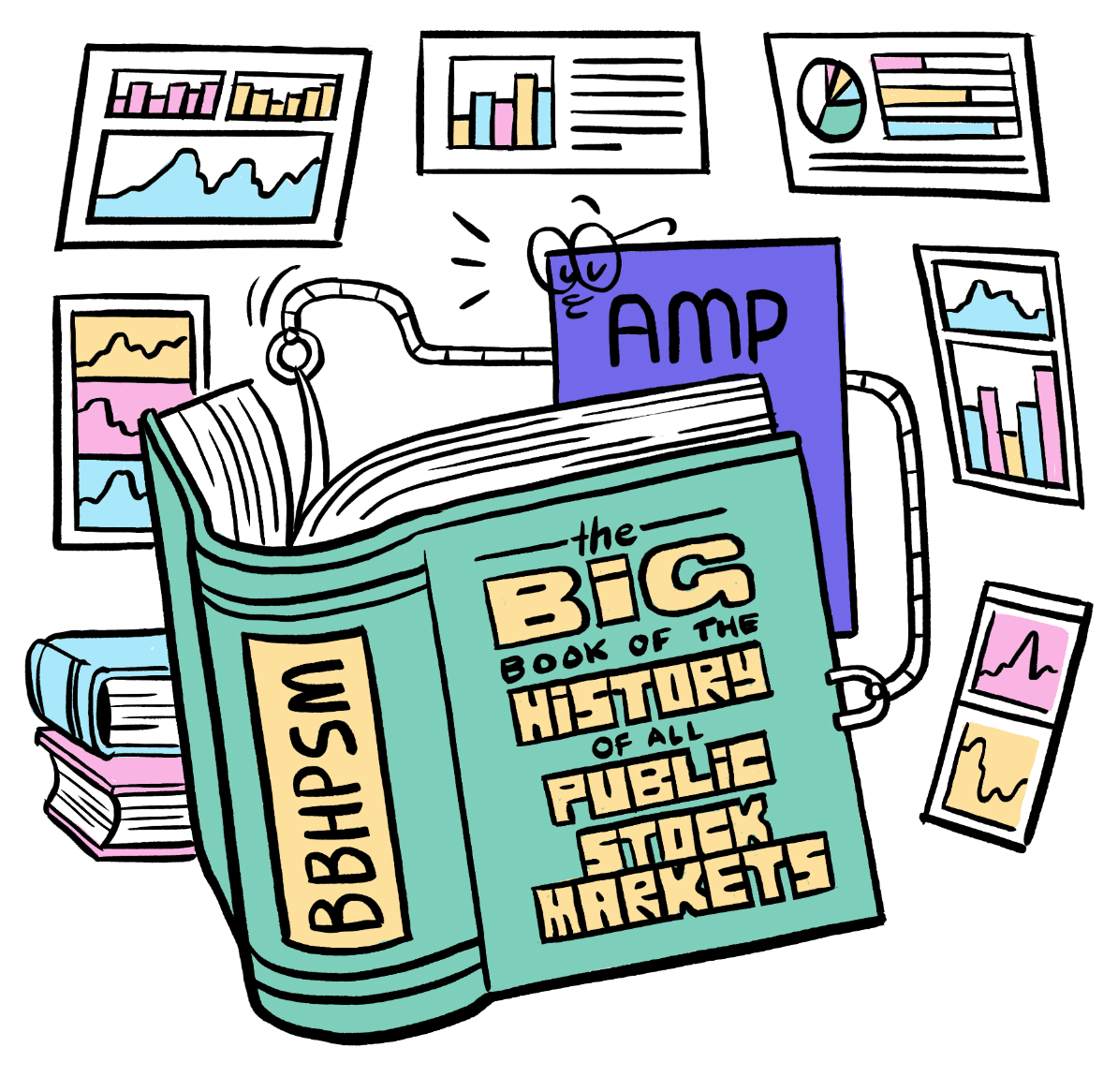

We then apply machine learning models trained over vast market histories and financial data sets…

…using a proprietary machine learning model to come up with the right allocations of the assets in the portfolio at that particular time.

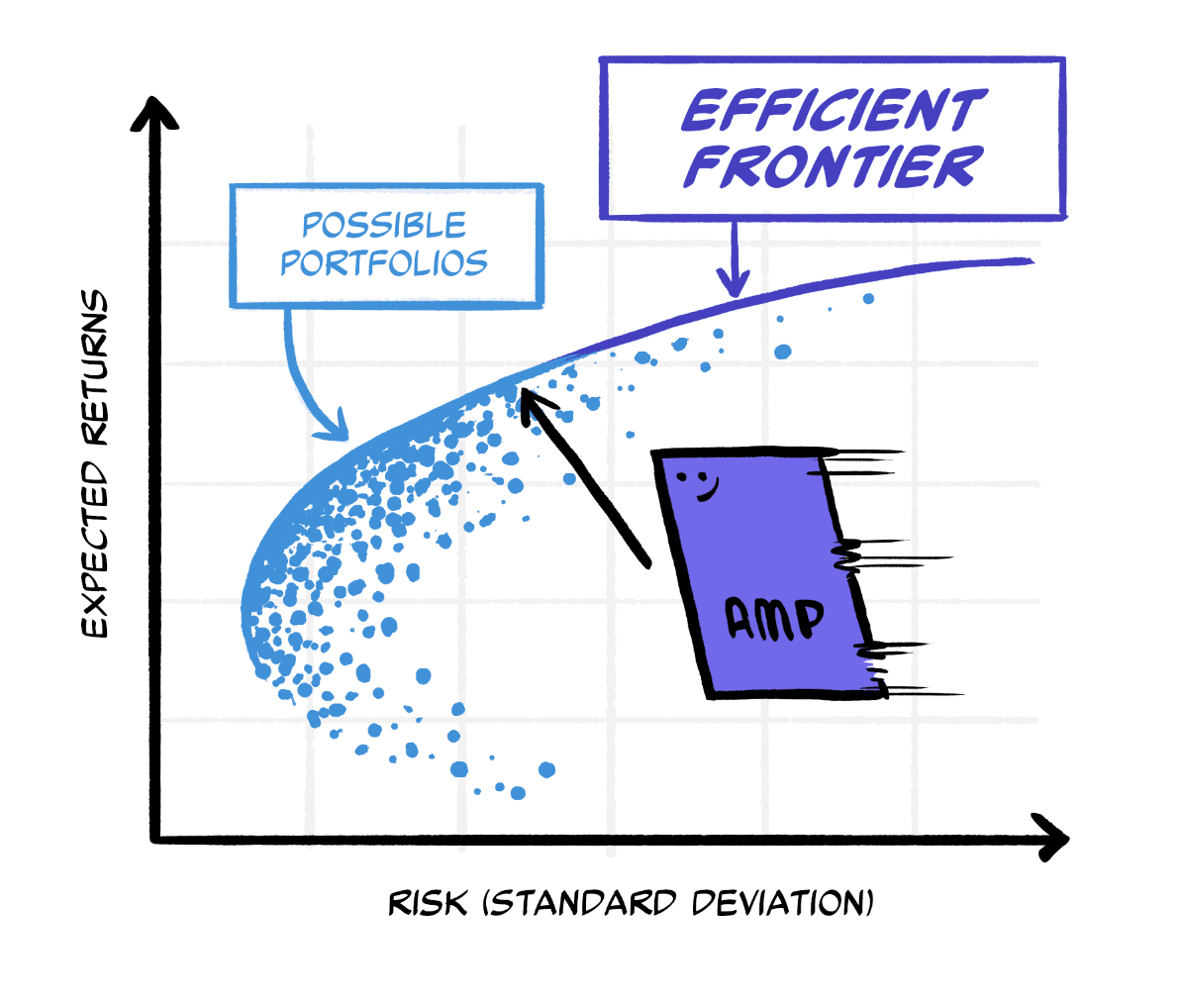

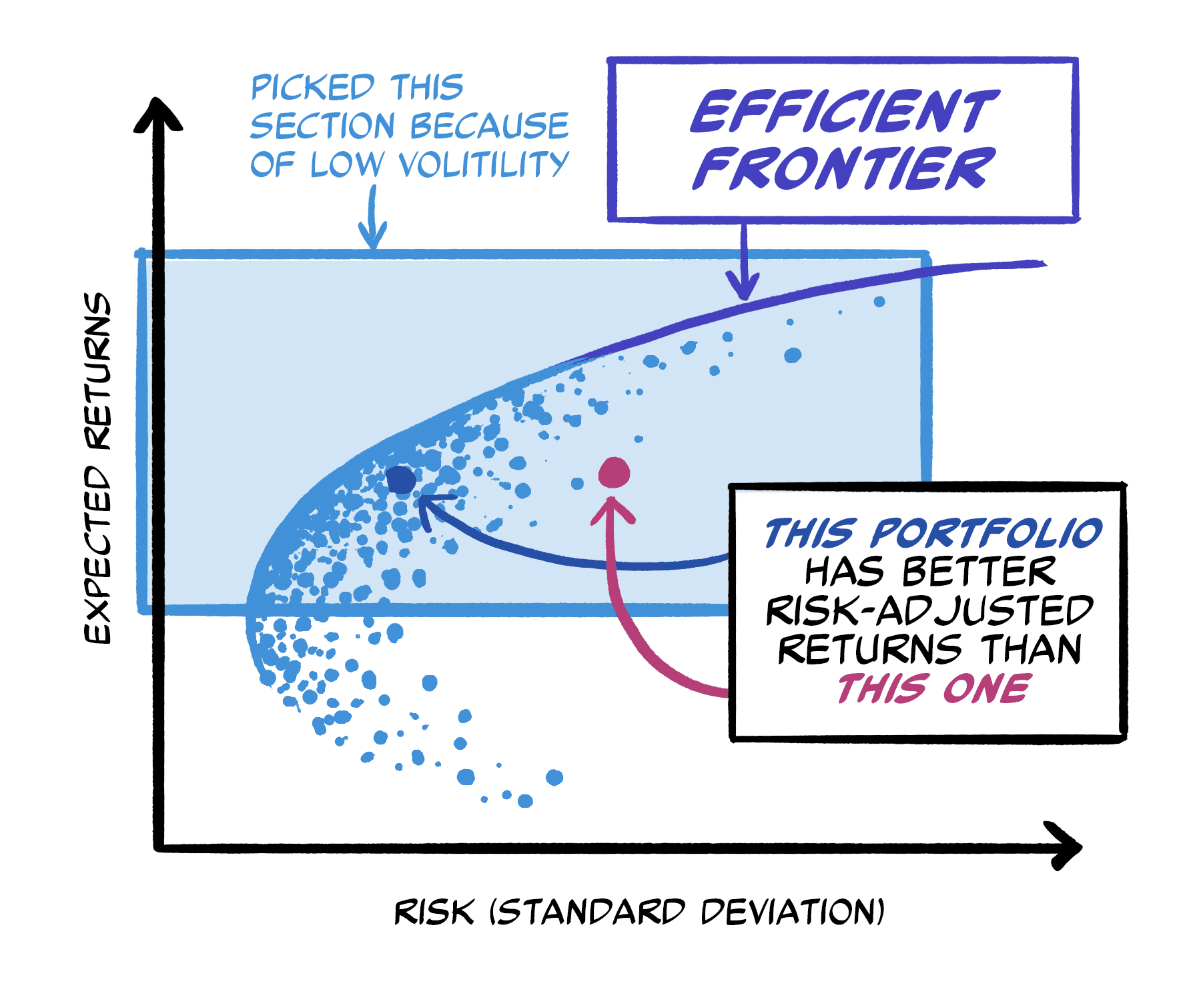

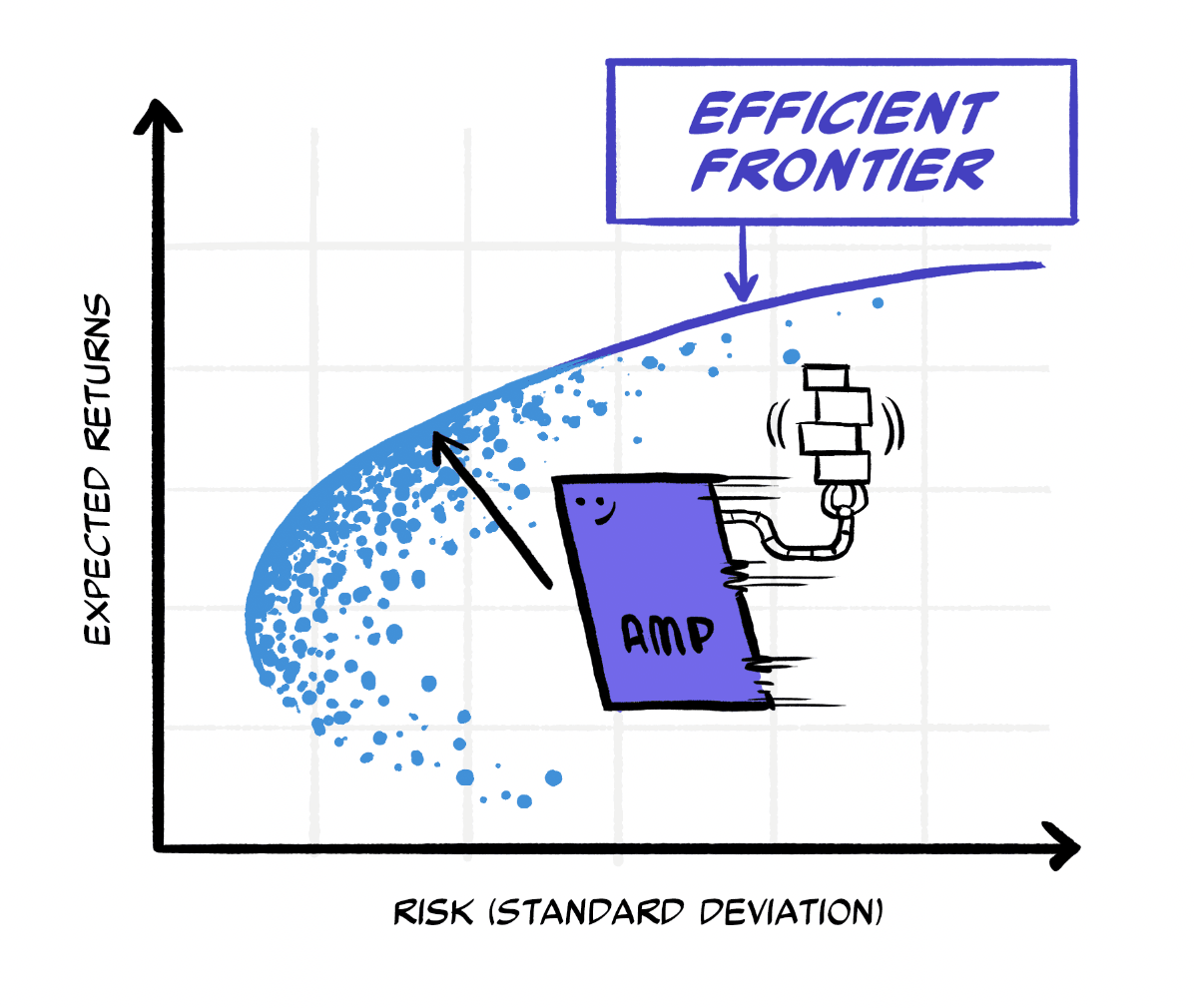

This is important because as the market changes the allocation needs to change in order to get closer to what’s called the efficient frontier.

The smartest investors know that the holy grail of investing is a portfolio with the maximum amount of returns for the lowest level of risk.

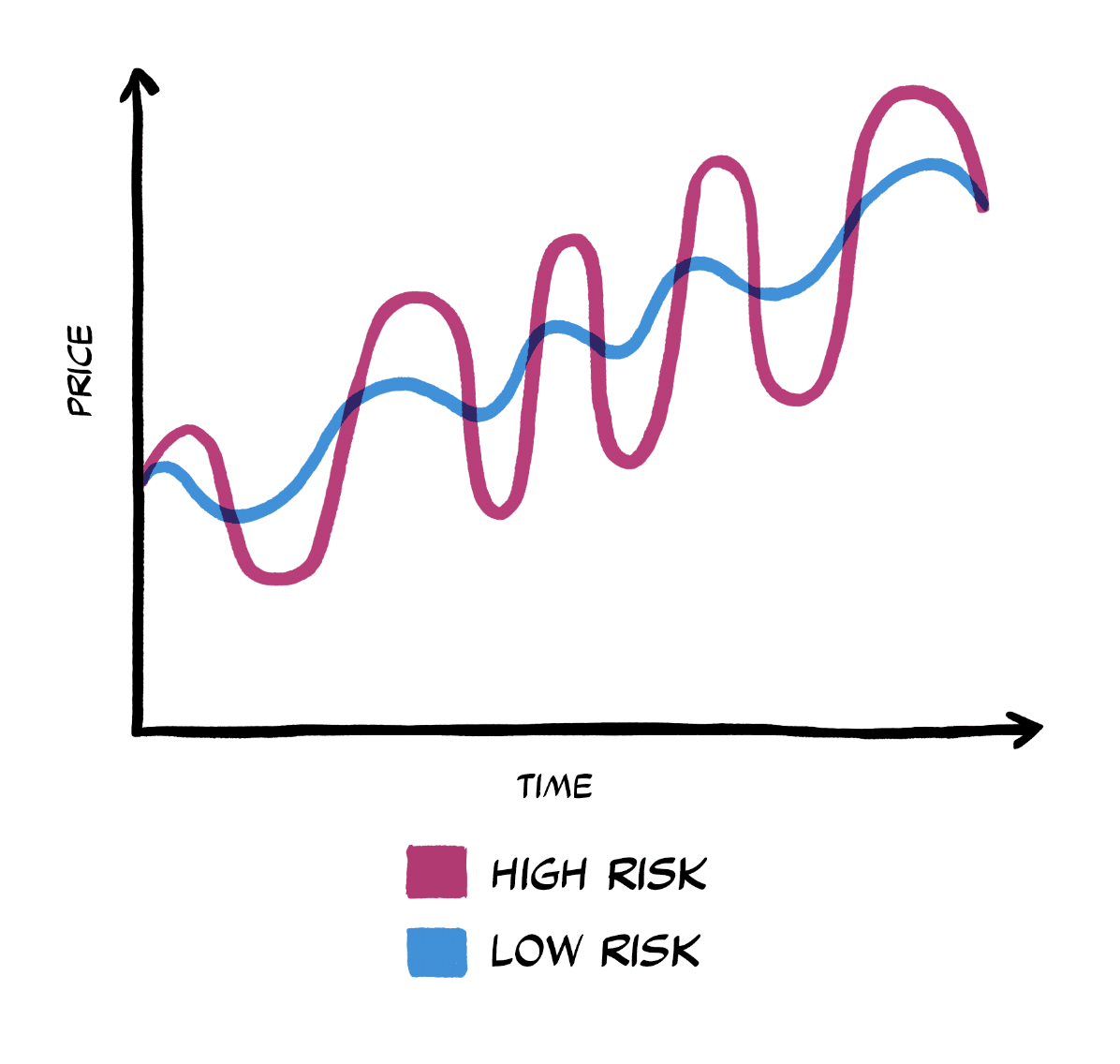

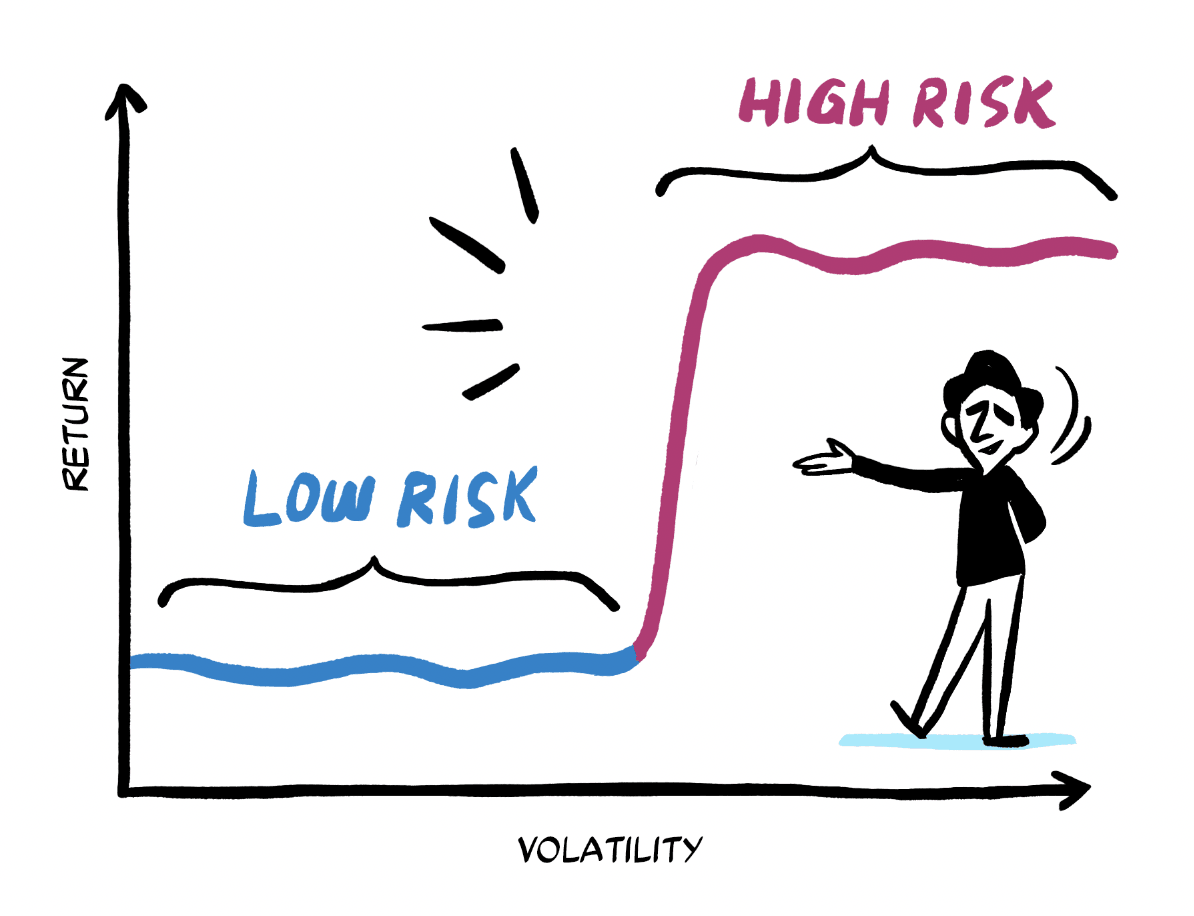

This is the theory underlying AMPs. Lower risk portfolios outperform higher-risk portfolios on a risk-adjusted basis

Imagine two portfolios that achieve the same returns, with different levels of risk.

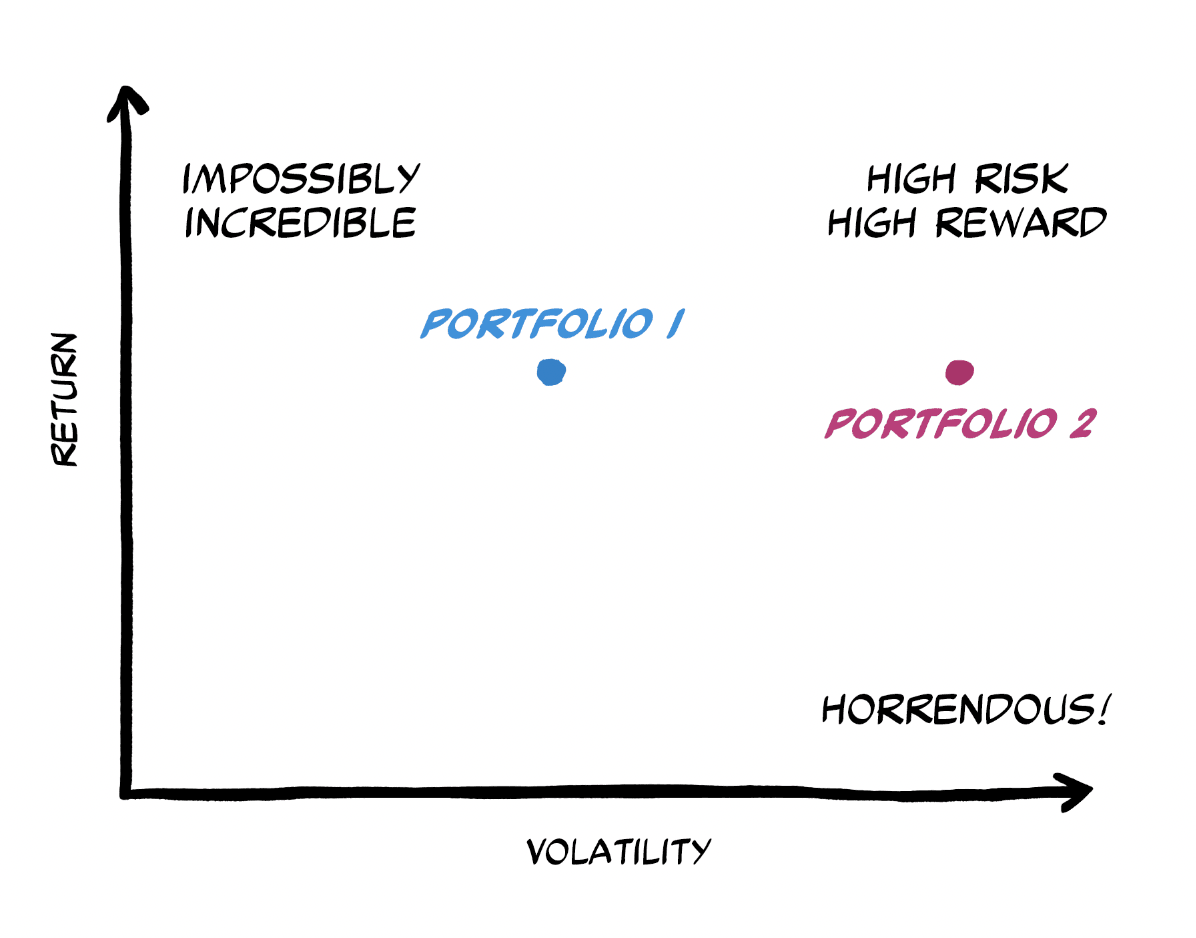

So, obviously portfolios closer to the top left are better than ones to the bottom right.

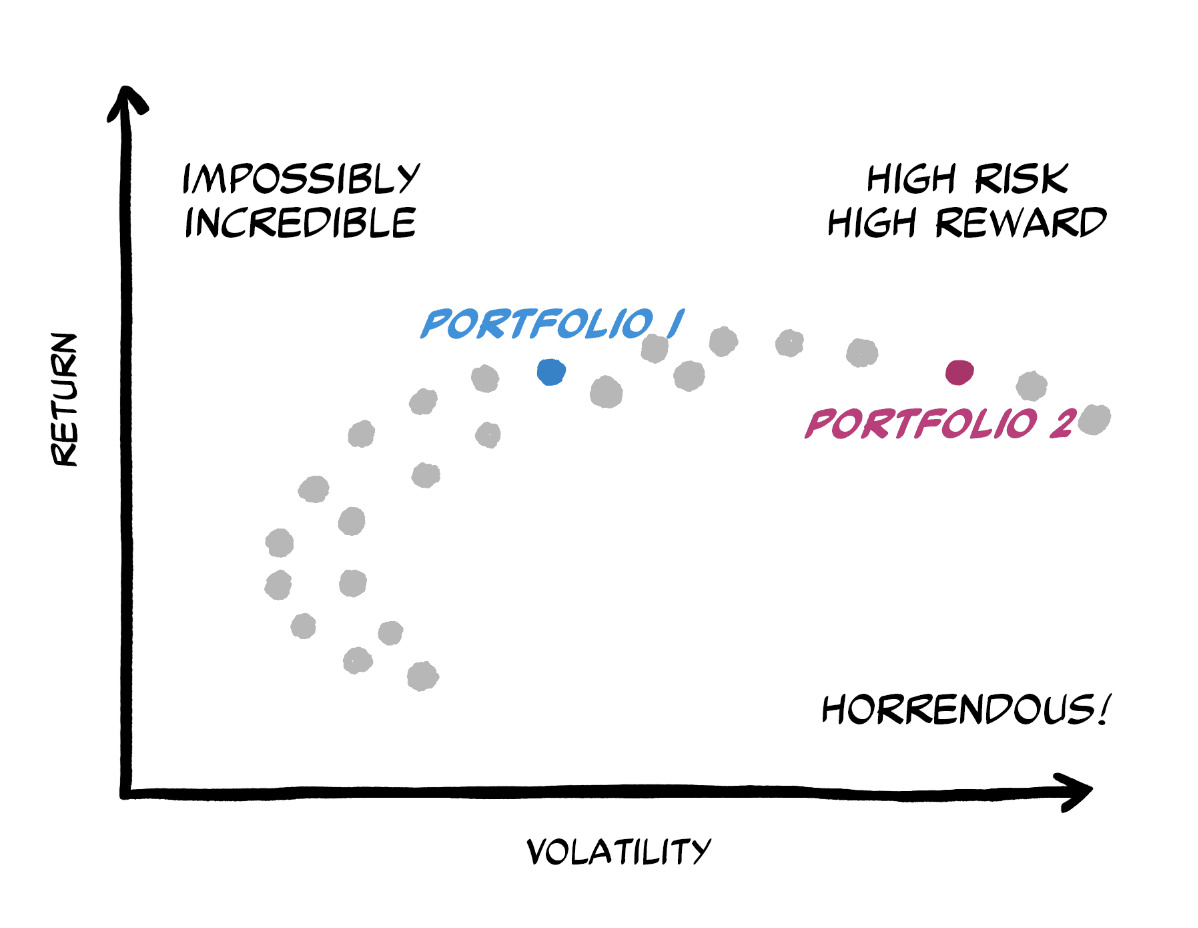

We can estimate how well a selection of assets can do at a given time and plot them against their risk.

As we plot more possible portfolios, they begin to form a pattern called the efficient frontier!

While there is no perfect investment that gets you all the returns with no risk, the closer your portfolio is to the efficient frontier, the better your risk-adjusted returns are.

Why isn't everyone doing this?

Because it’s easy in theory, but very hard in practice. You see, what is low-risk today won’t necessarily be low-risk in the future, and vice versa.

It’s very difficult for a human to frequently analyze the risk of all possible combinations of assets. But, it’s easy for an AMP!

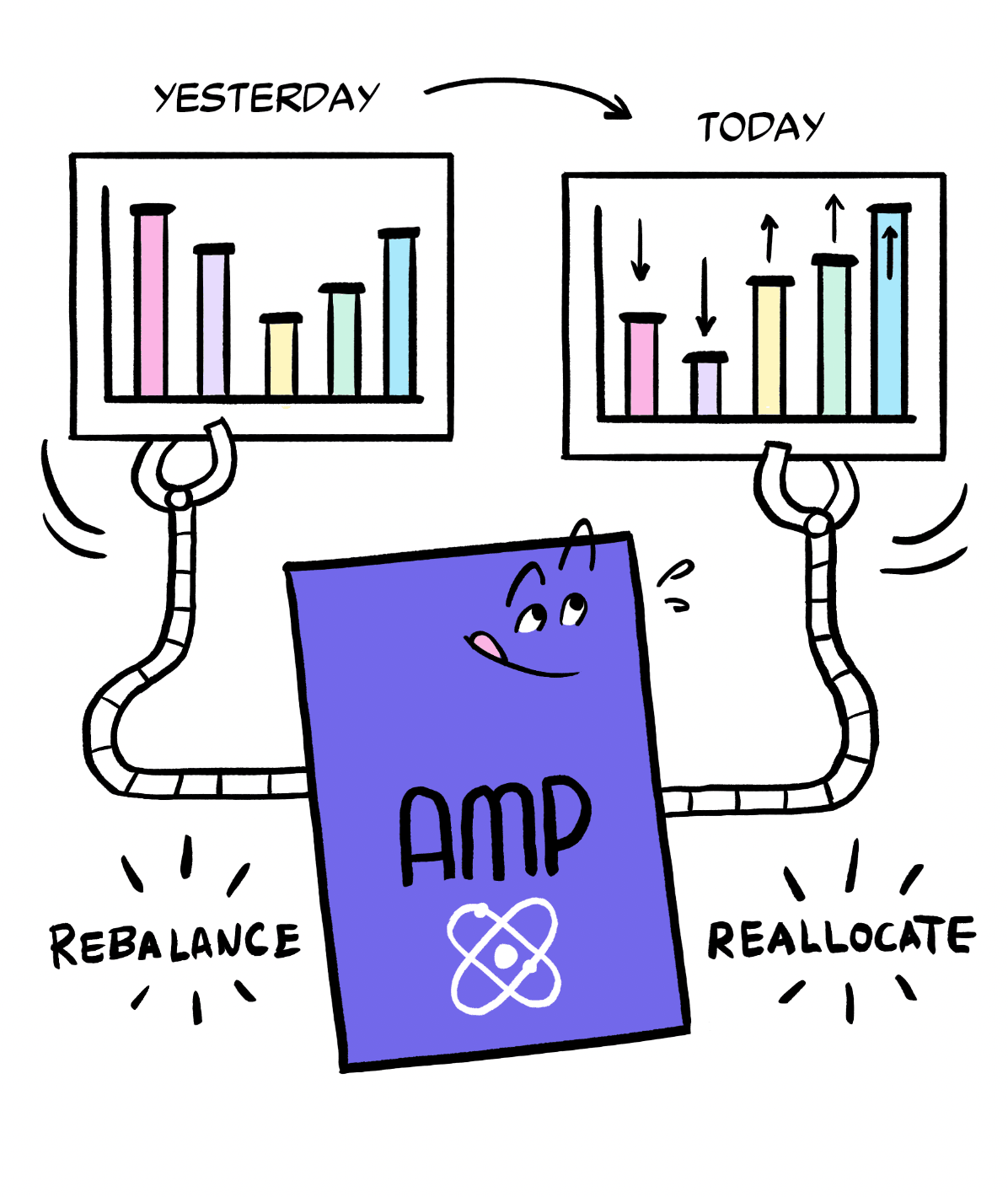

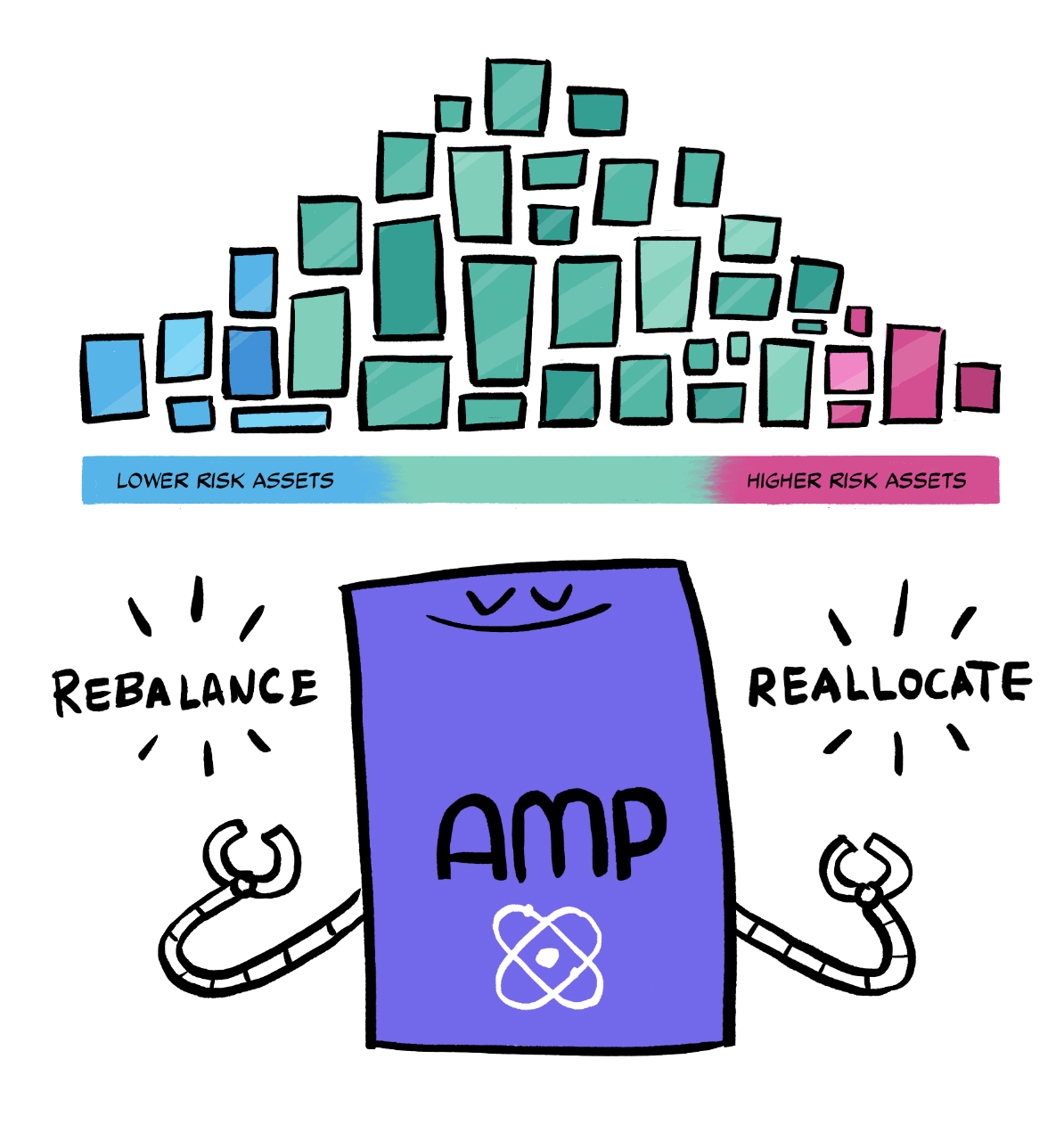

AMPs constantly analyze the market. If assets in the portfolio become too risky, it will sell some.

If there are other assets available that qualify, it will buy some to rebalance and reallocate to harmoniously achieve the desired level of risk.

This buying and selling regularly “rebalances and reallocates” the portfolio, allowing it to keep a consistent low-risk level.

AMPs can change assets and allocations as often as monthly and rebalance as often as daily. The goal is to get the portfolio closer to the efficient frontier, resulting in better risk-adjusted returns.

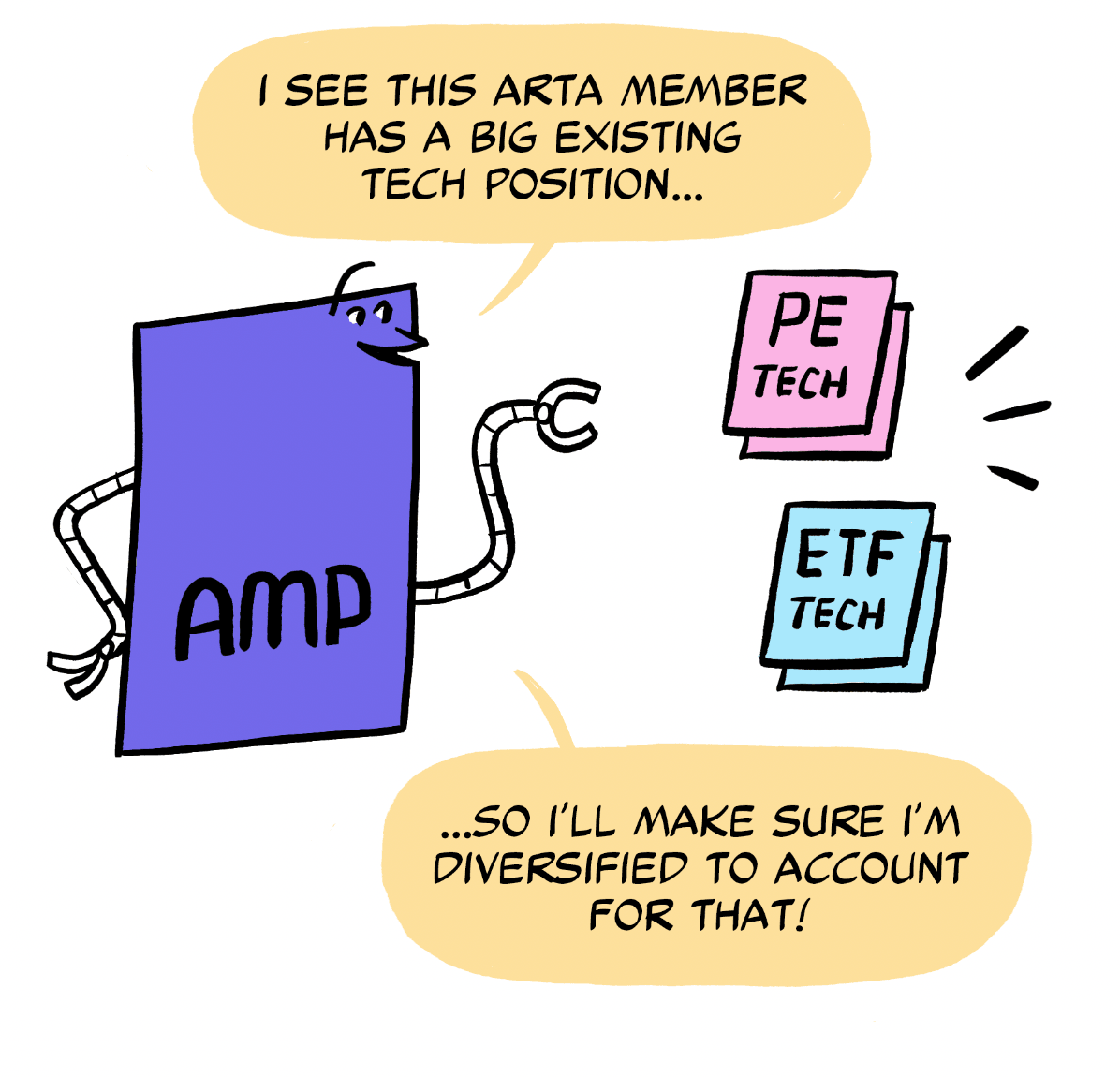

Members can express their investment objectives and risk preferences today, and soon they’ll be able to specify sector or geographic preference if they want to.

You also directly own the assets in your AMPs, which means any tax advantages from the methodologies or the assets (for example, US Treasuries do not attract US State taxes) flow straight to you.

What does it cost?

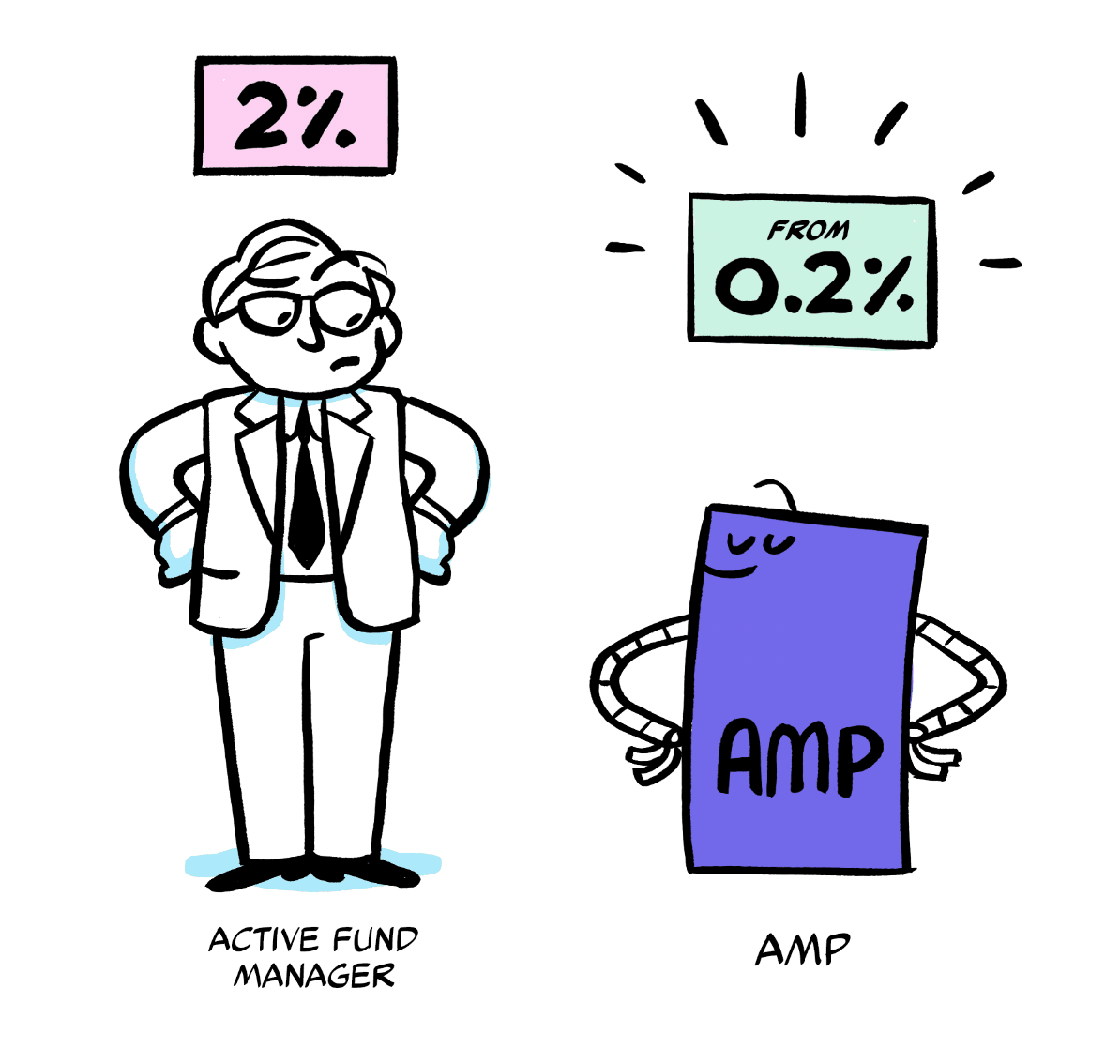

Active fund managers often charge the equivalent of 1% - 2% of your Assets Under Management (AUM).

But, because of AMPs’ extensive use of technology, we can charge far less!

Why should I trust AMPs?

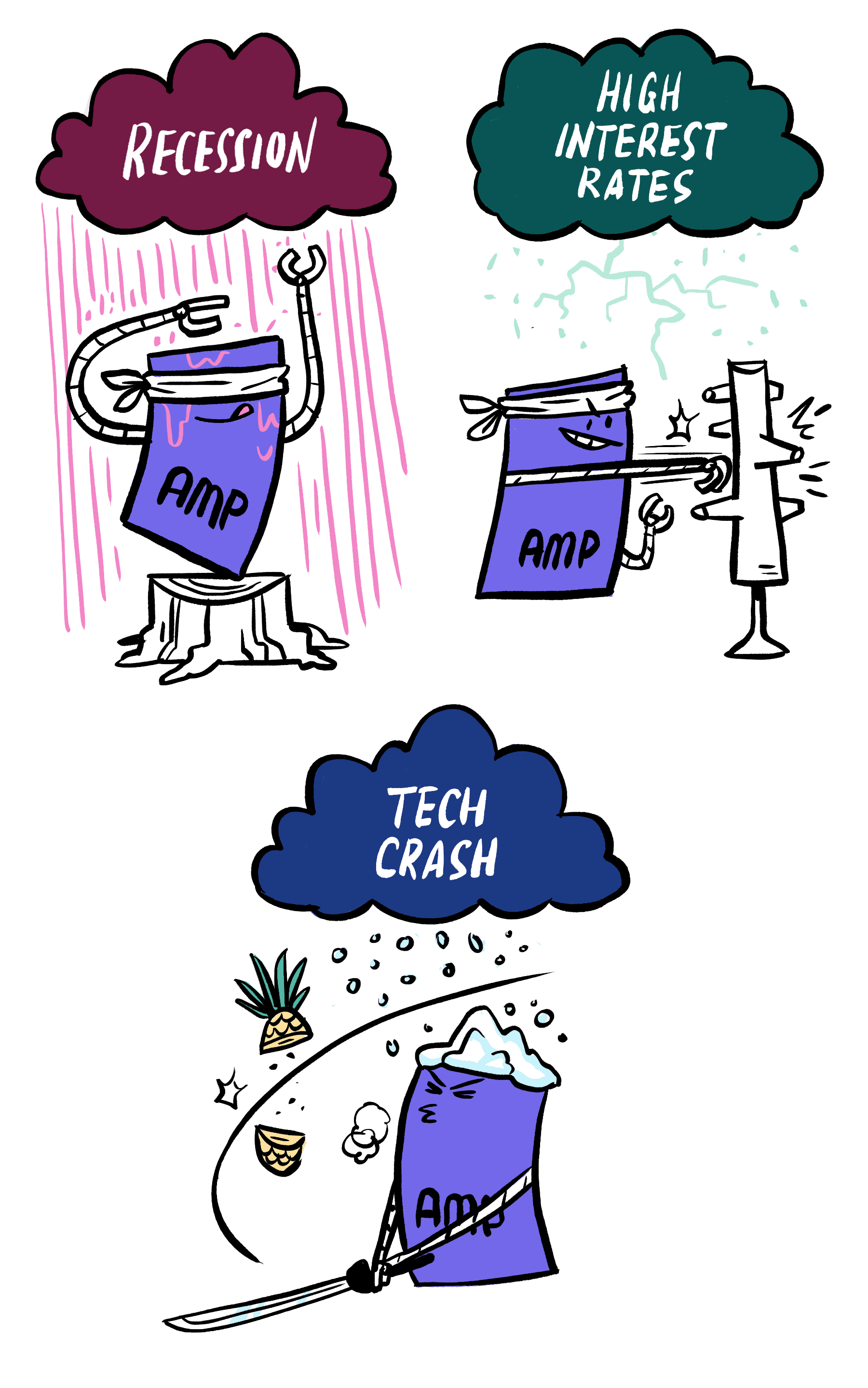

AMPs are tested rigorously - on out-of-sample data, against hypothetical scenarios to simulate different market conditions, against industry standard factor models — and finally in the actual market with Arta’s own money. Only then are they released to Arta’s members.

While in operation, AMPs are systematically monitored for safety and controls under human expert supervision. AMPs are also regularly reviewed by Arta’s Investment Committee to ensure they are performing as we’ve built them to.

At the moment, AMPs trade highly liquid ETFs, and will soon expand to include individual stocks. AMPs continually improve, with upgrades to the models, changes to the asset universe, or additional data - for example risk or factor data from industry providers. Today, we have Defensive Growth, High-Yield Cash Reserve, and Income Bonds that are tuned for popular investor goals with many more in the pipeline.

We are making new AMPs and improving them all the time, so stay tuned for more!

We’re super proud of our AMPs and everything we’ve built here at Arta, and we’re now ready for you to use it! You can download the Arta app here.

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.