Are you over-concentrated? There are a few ways we can help...

But read on to see if you too much of your wealth is one asset!

Relax! We can help! If too much of your wealth is in one asset — many experts would say more than 10% — then you’re over-concentrated.

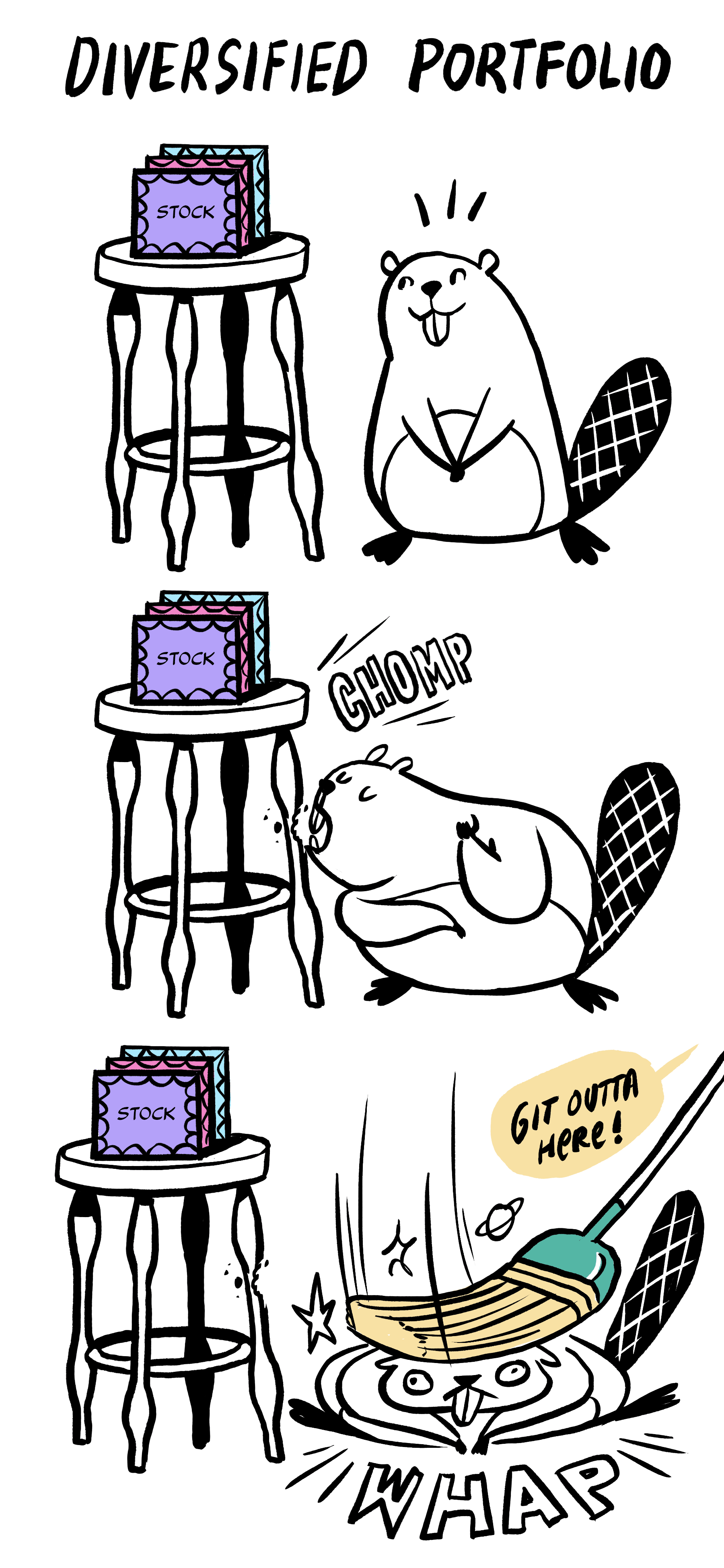

Individual stocks can suddenly lose a lot of value if something happens to the company or the industry that it’s in, whereas a diversified portfolio is much less likely to suddenly lose so much.

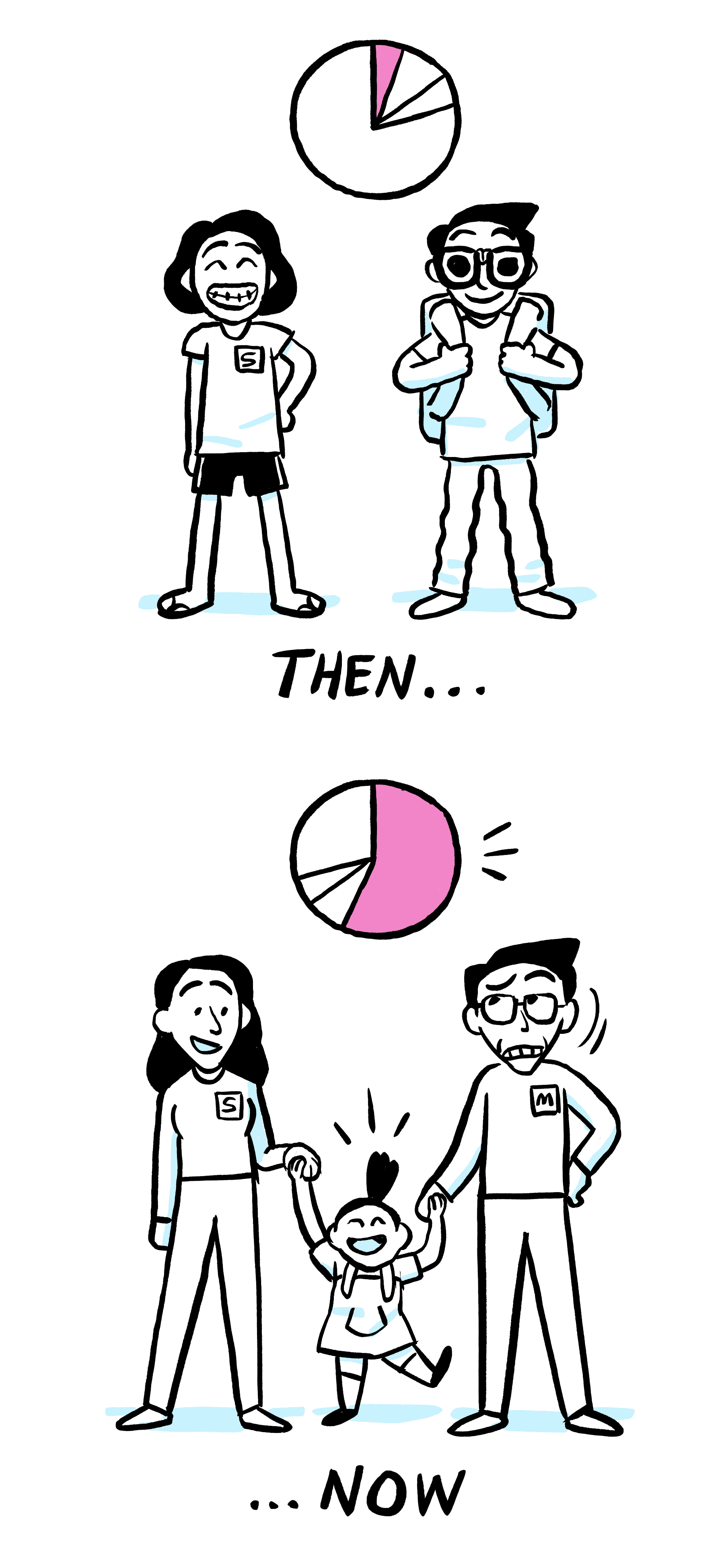

For a lot of Arta members, this happens because a major part of their compensation is in the form of company stock.

Over the years, as stock grants vest, your portfolio can become pretty over-concentrated.

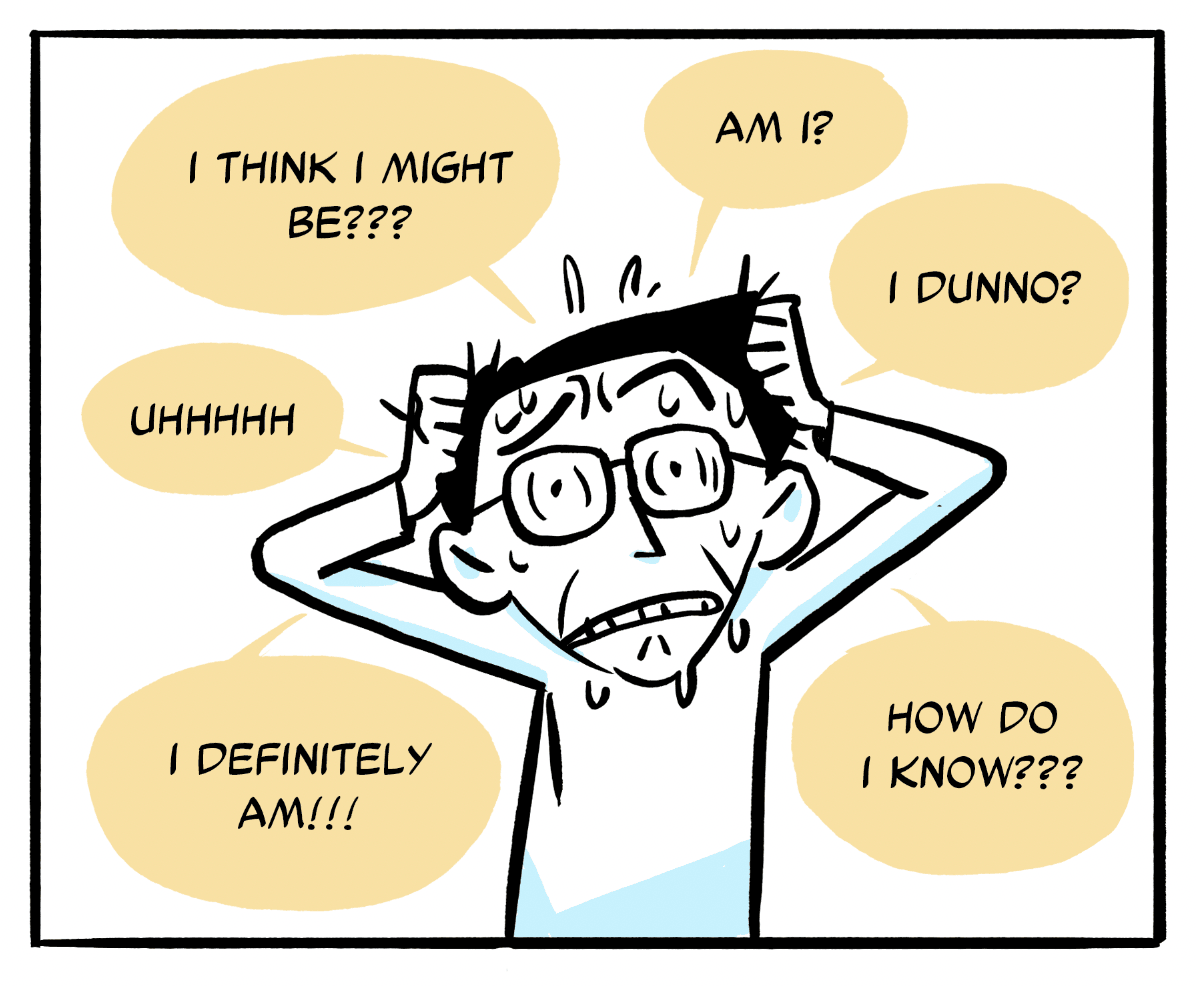

It can be really easy to just hold on to your company stock — especially if it’s performing well!

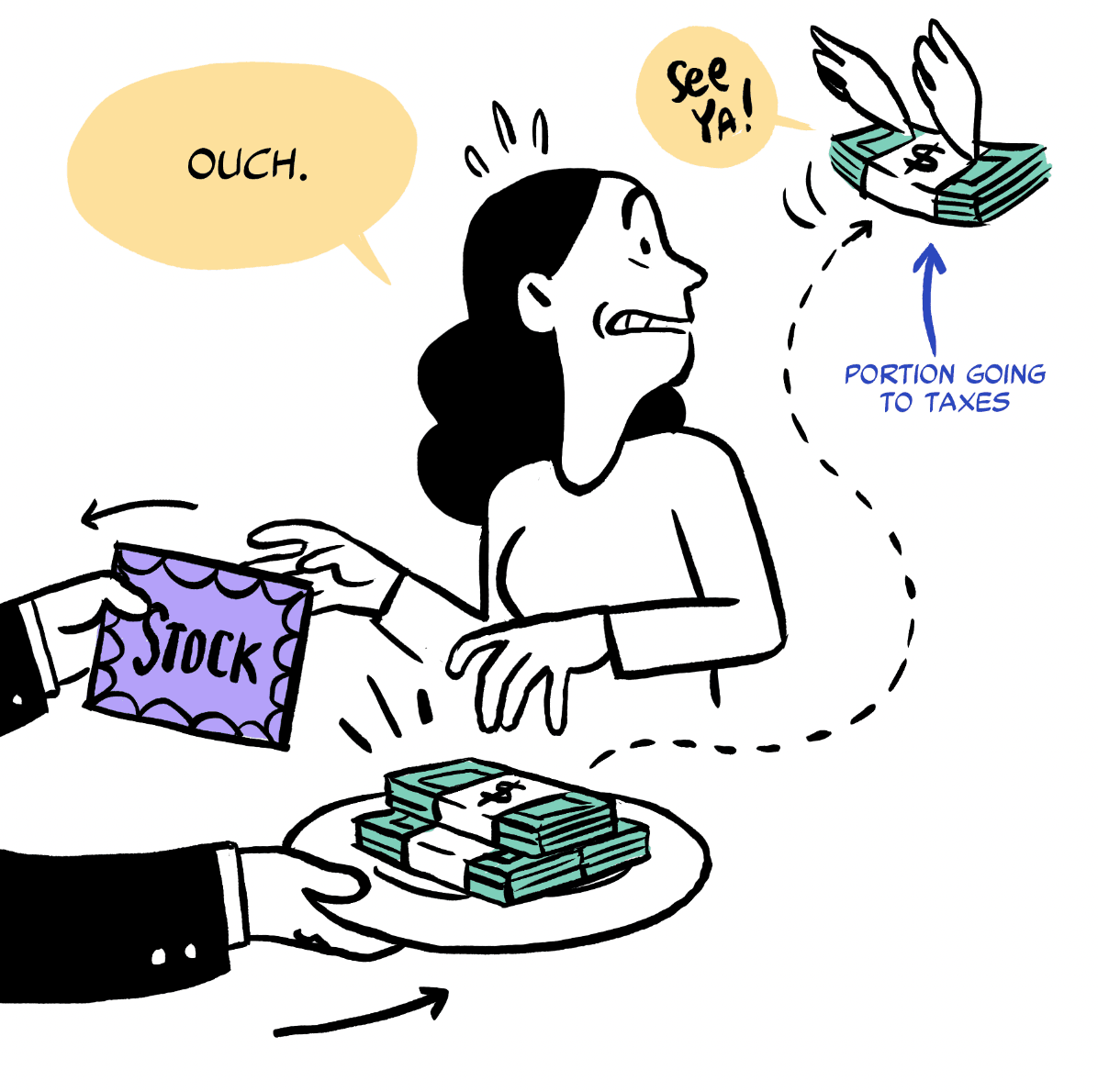

I mean, it kind of hurts to pay taxes when you sell it.

And if you do sell it… then you have to figure out what to do with the money.

So, lots of people hold their company stock, watch it grow, get rich on paper…

…and then watch it crash.

Maybe because the whole industry dropped — remember the tech industry during the dot com bust? Or financial companies in 2008?

Or maybe something happened to the company — like a corporate scandal or a competitor launches a breakthrough product.

And because they stayed over-concentrated, they don’t have the options to deal with it.

Don’t worry!

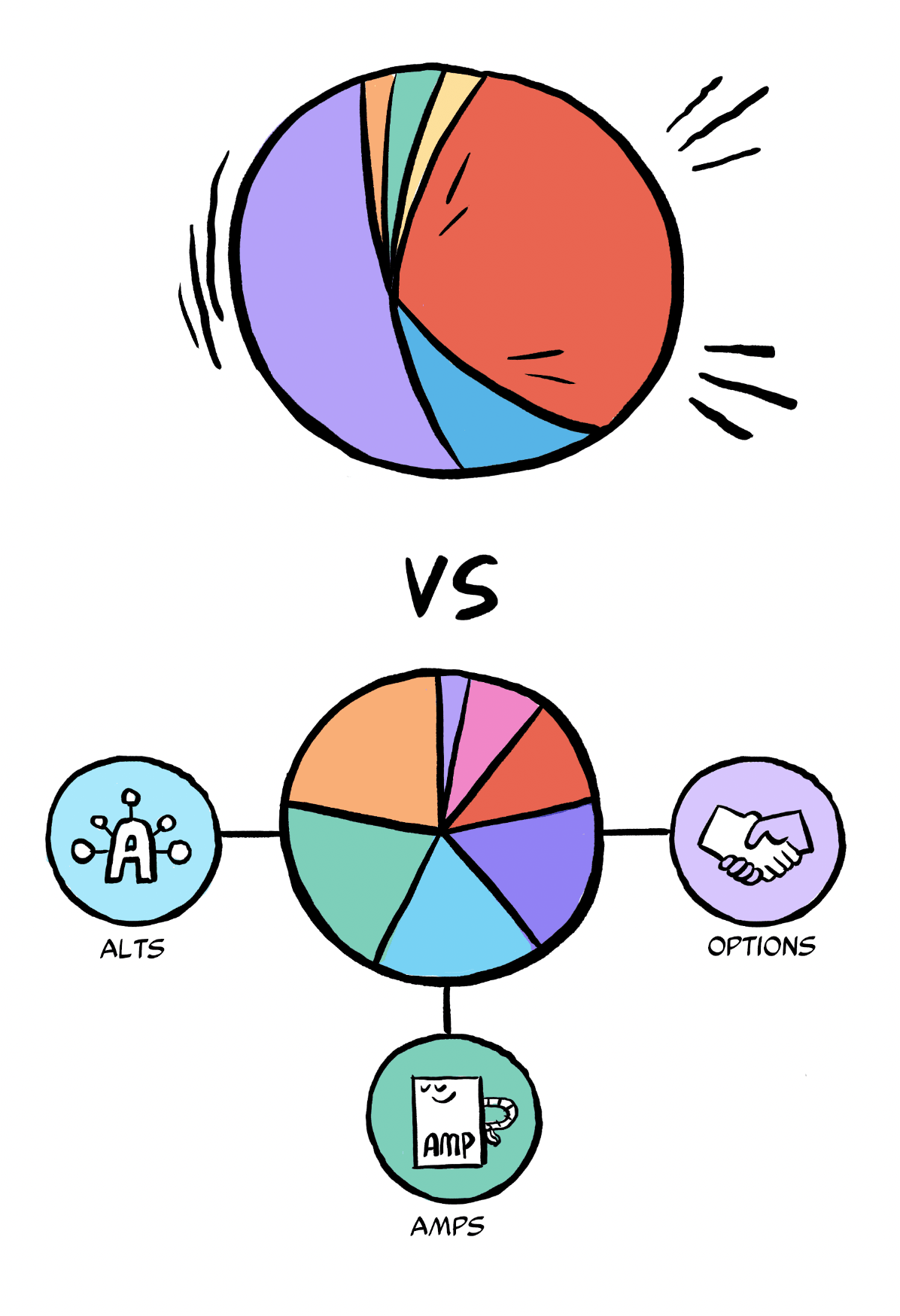

Arta can help you avoid this situation! Here are 3 amazing things Arta does to strengthen your portfolio like the ultra-wealthy:

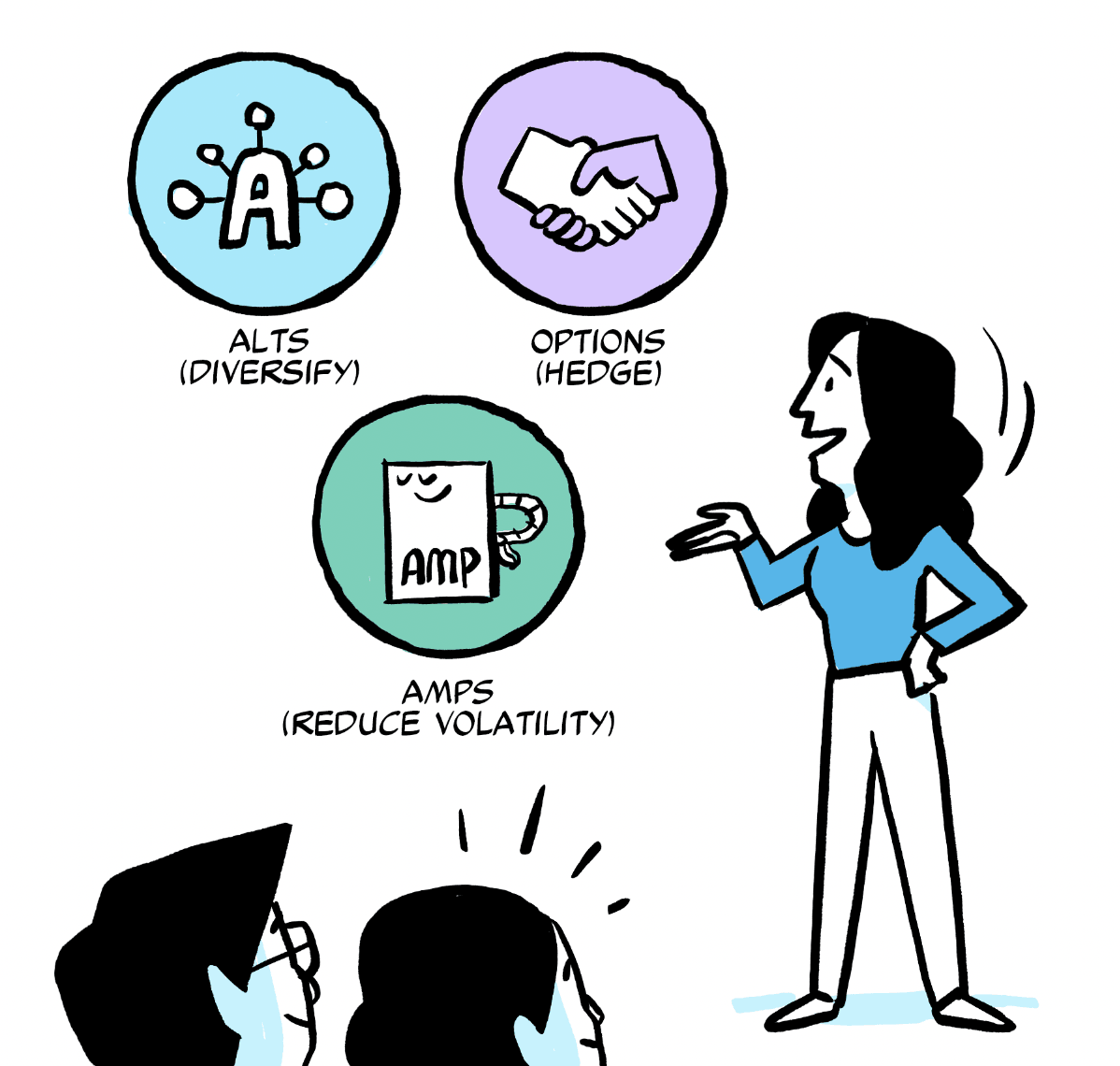

Diversify with Alternative Assets (Alts)

Hedge against losses with Options

Reduce industry exposure and volatility with AI Managed Portfolios (AMPs)

Let’s start with investing in Alternative Assets — also known as Private Assets.

Alts

Diversify by investing in alternative assets: venture capital, private equity and real estate.

Why?

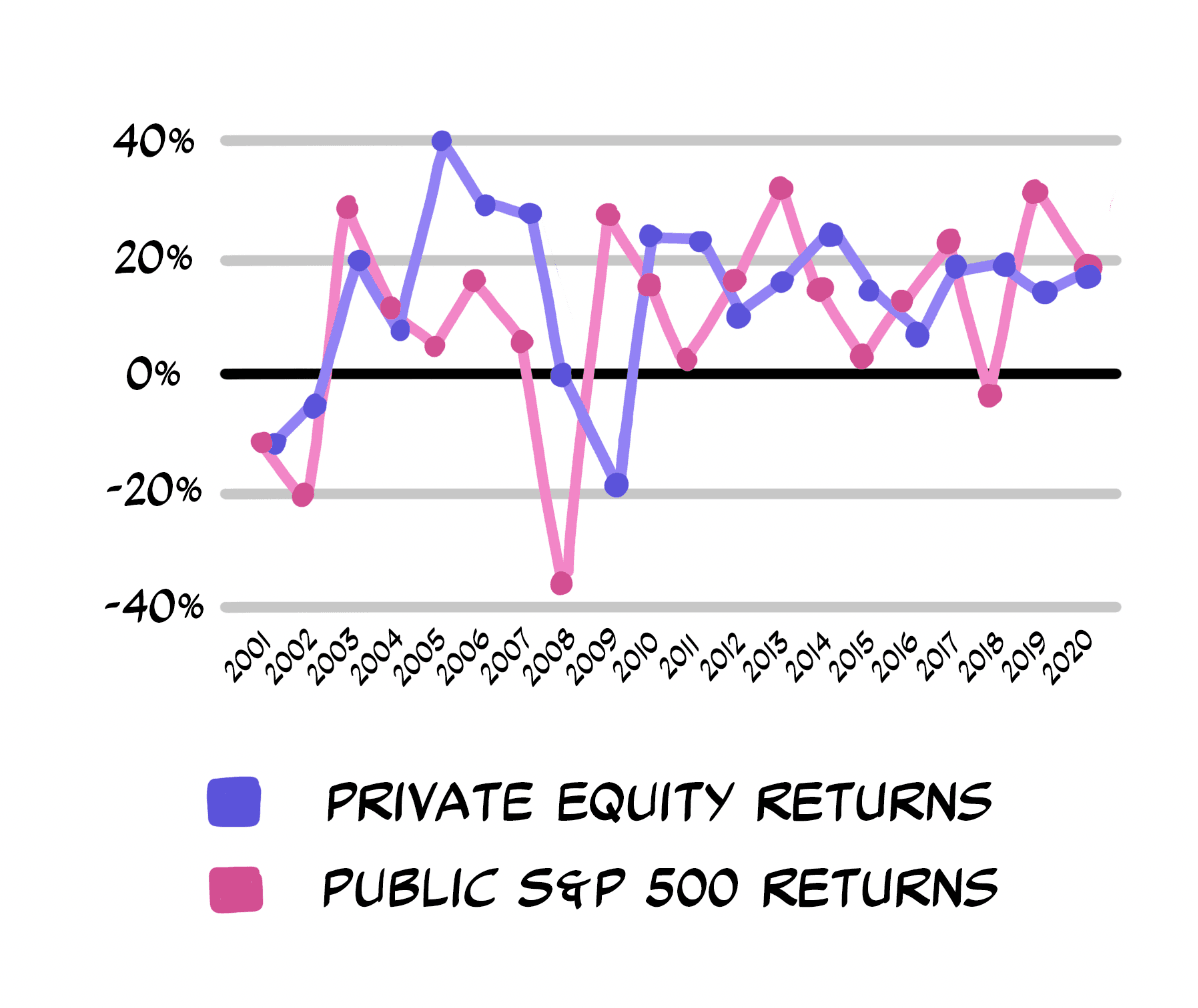

Because they are less correlated to public markets, so it’s a great way to diversify your wealth. For example, Private Equity is only correlated 41% of the time to the stock market (Russell Investments Strategic Planning Forecasts, March 2022).

This gives you opportunities for growth even if all the markets for public assets are down.

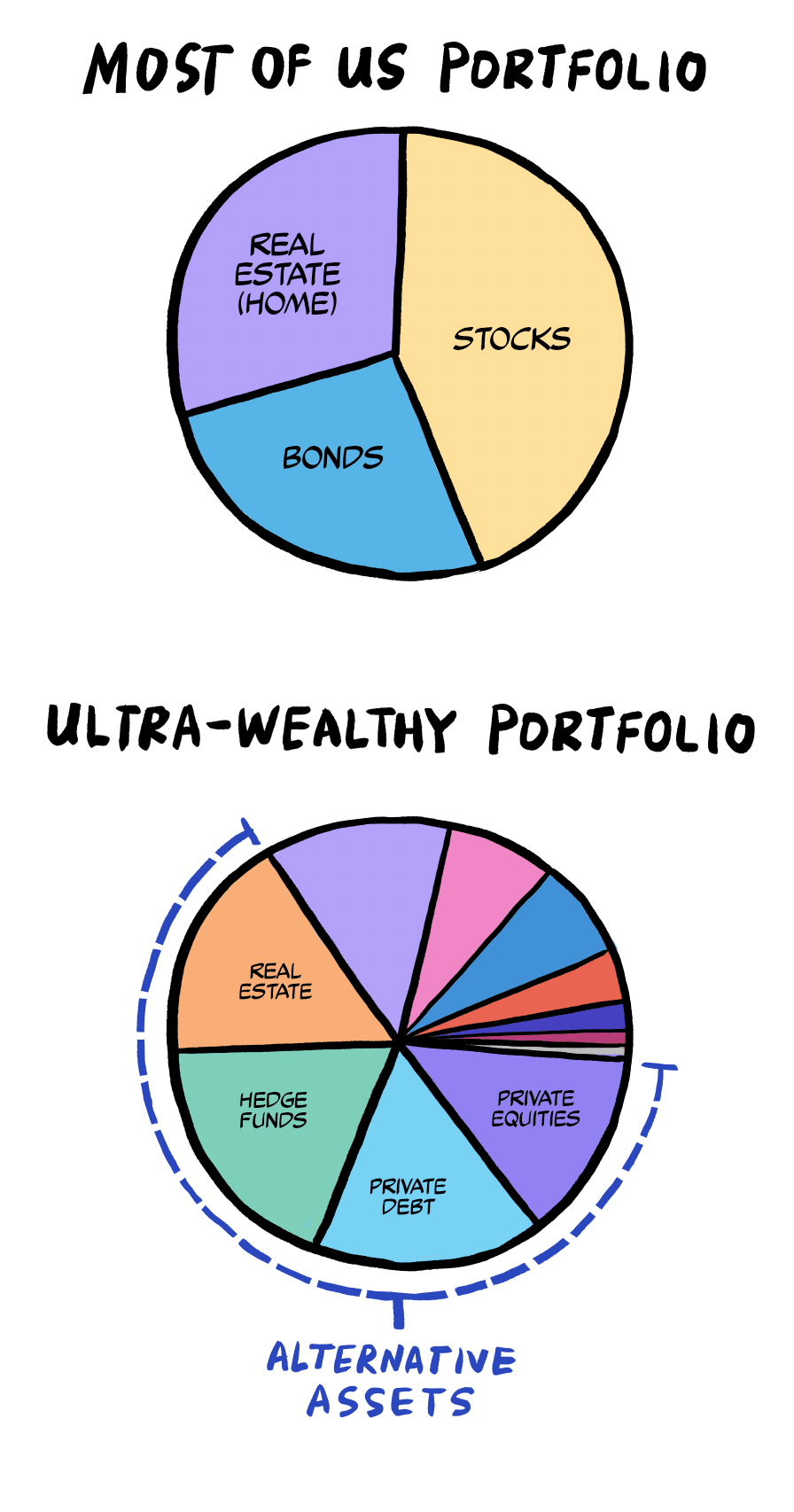

Ultra-wealthy folks often have nearly half of their portfolios in alternative assets. With Arta, you can too.

Need some time to move out of an over-concentrated position? Options are a great way to hedge while you do so.

Options

Options are a great way to give you time to thoughtfully diversify out of your over-concentrated position, and reduce the chances of a big loss.

Say you want to start selling your company stock, but only when it reaches a certain price — either after it’s gained value, or before it loses too much value.

Arta can help you do both with Options, in a strategy we call Smart Hedging.

Smart Hedging gives you downside protection!

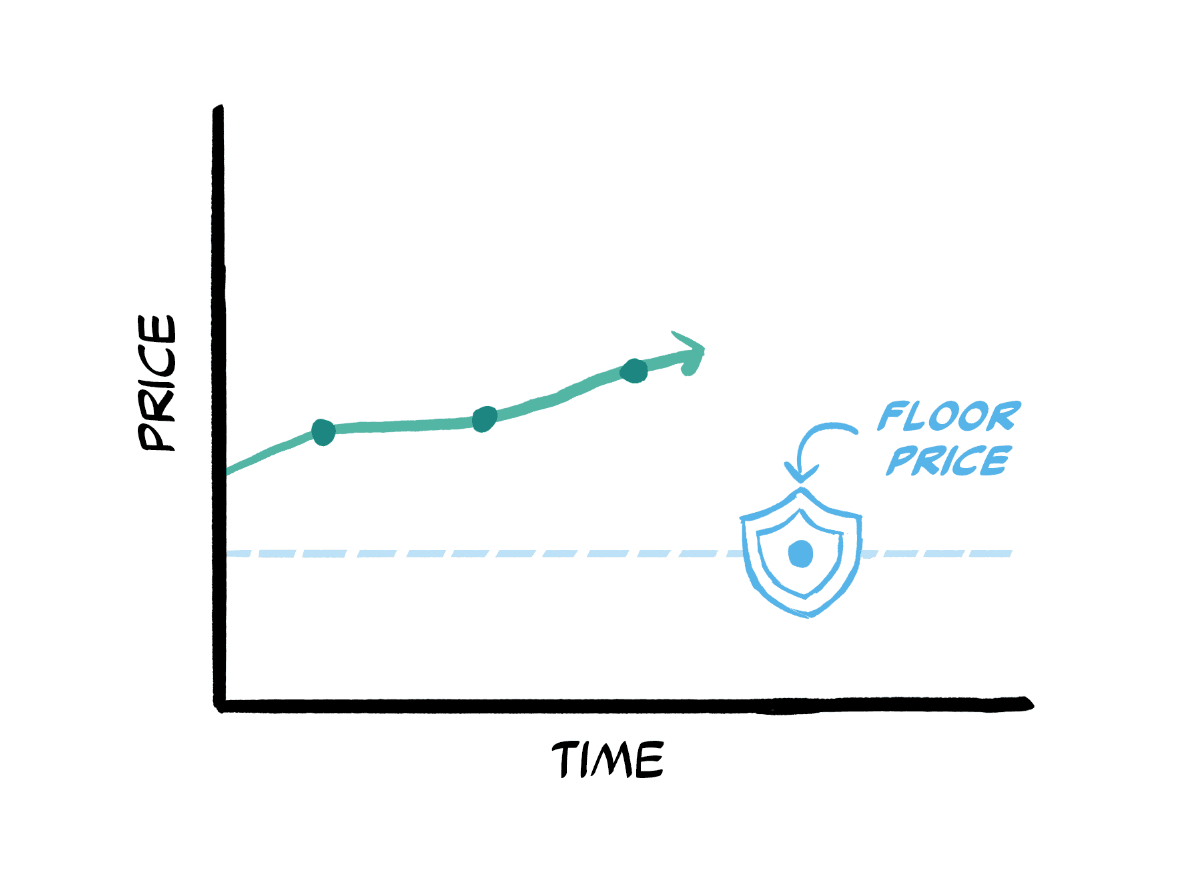

All you need to do is choose a floor price you’re willing to sell your over-concentrated asset at to protect against losses.

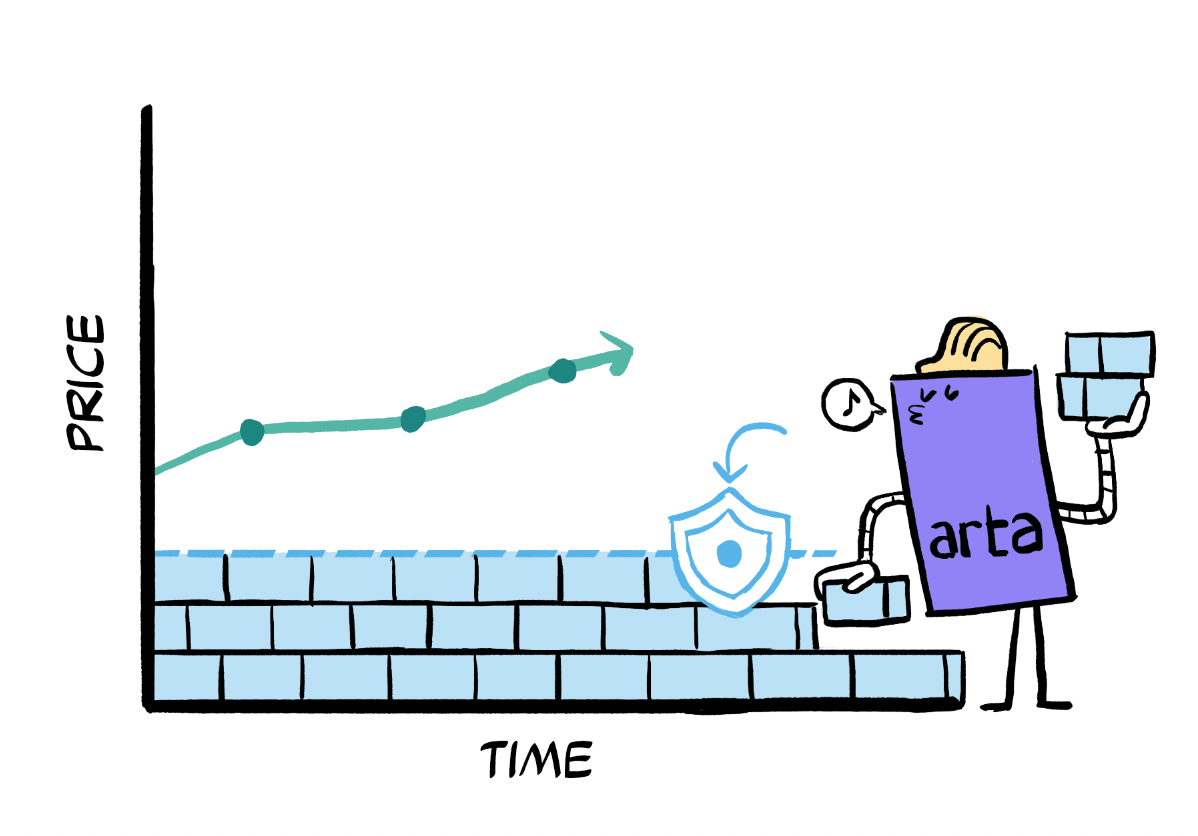

Arta will help you buy options at that price, allowing you to sell for your floor price, even if the stock falls more.

Arta will then sell options at a higher price for you, and use that cash to pay for the lower priced floor options.

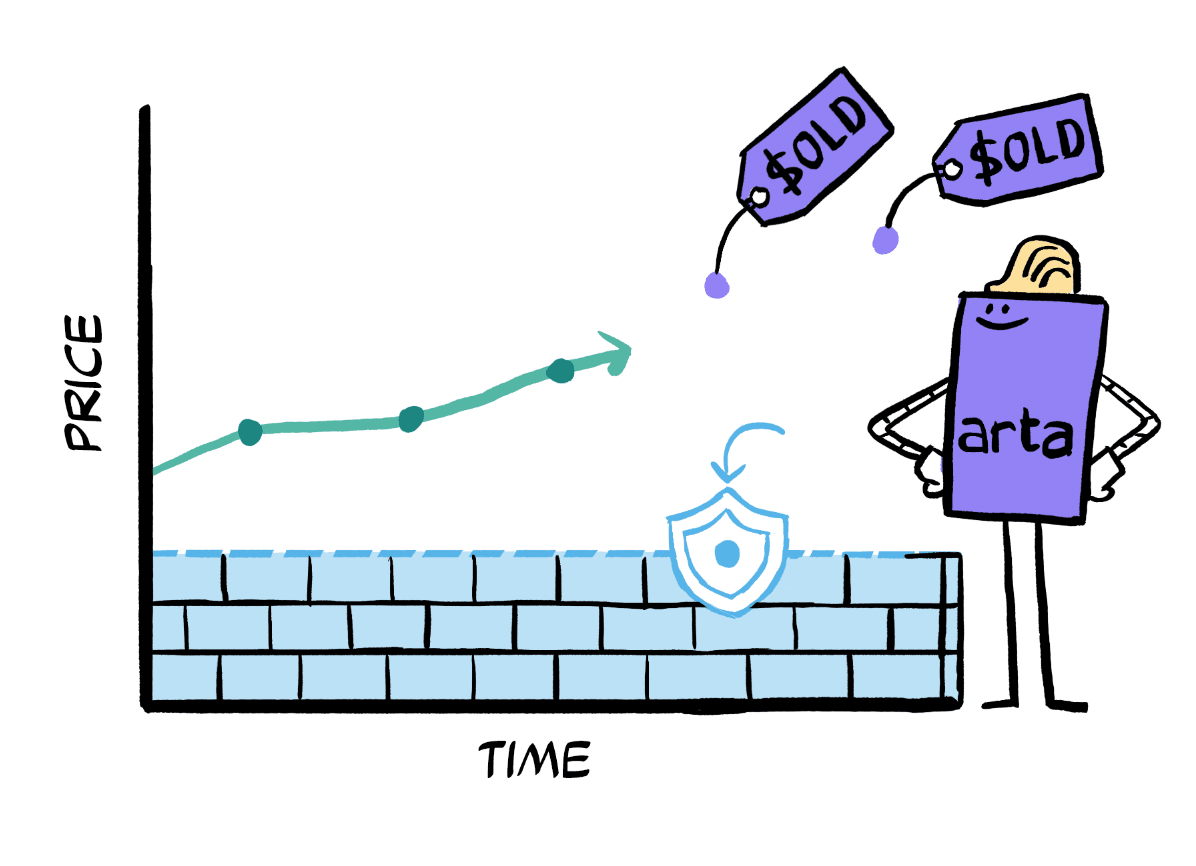

That means if the stock rises to the higher price, those stocks will be sold – which is great, because you’re selling them to get cash to diversify your portfolio!

Smart Hedging helps you lock-in financial stability as you thoughtfully move out of your over-concentrated position.

While investing in alternative assets is a great way to diversify, you may want to invest in more liquid public assets as well. AMPs are great for that!

AMPs

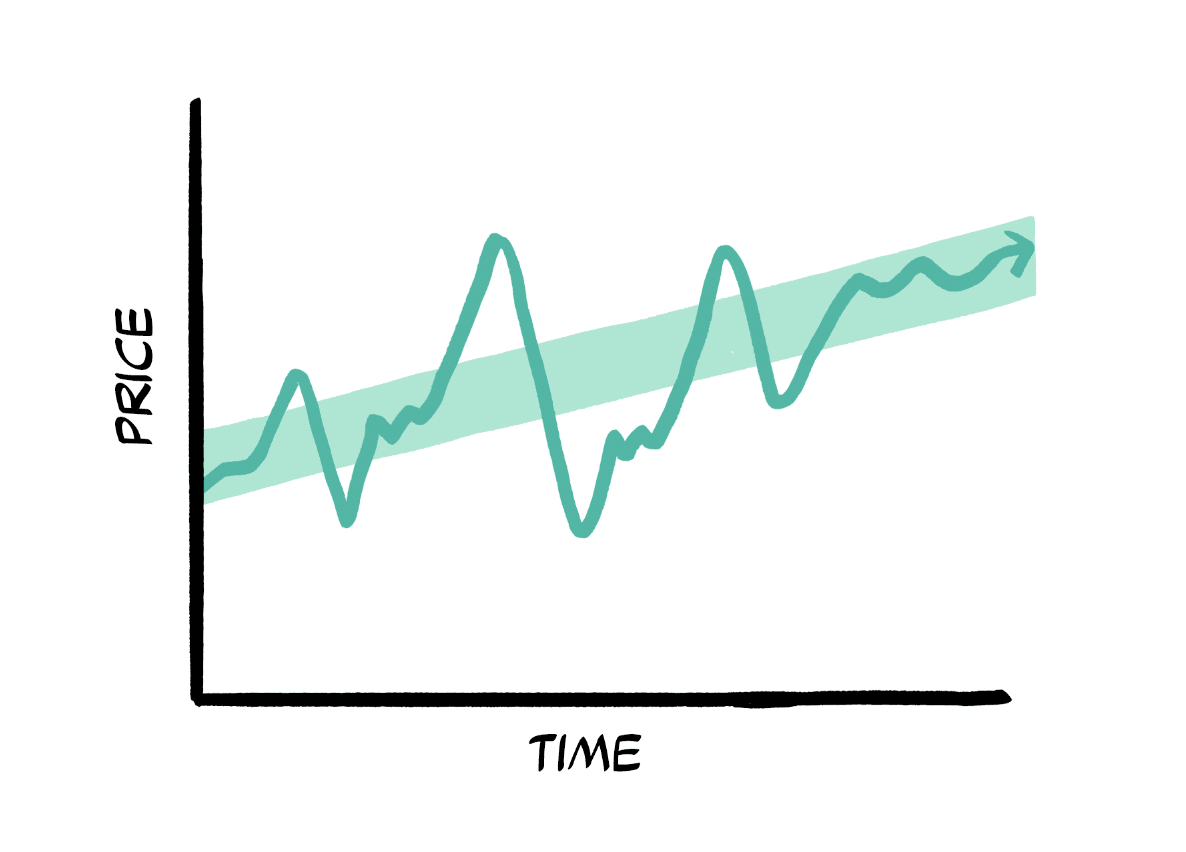

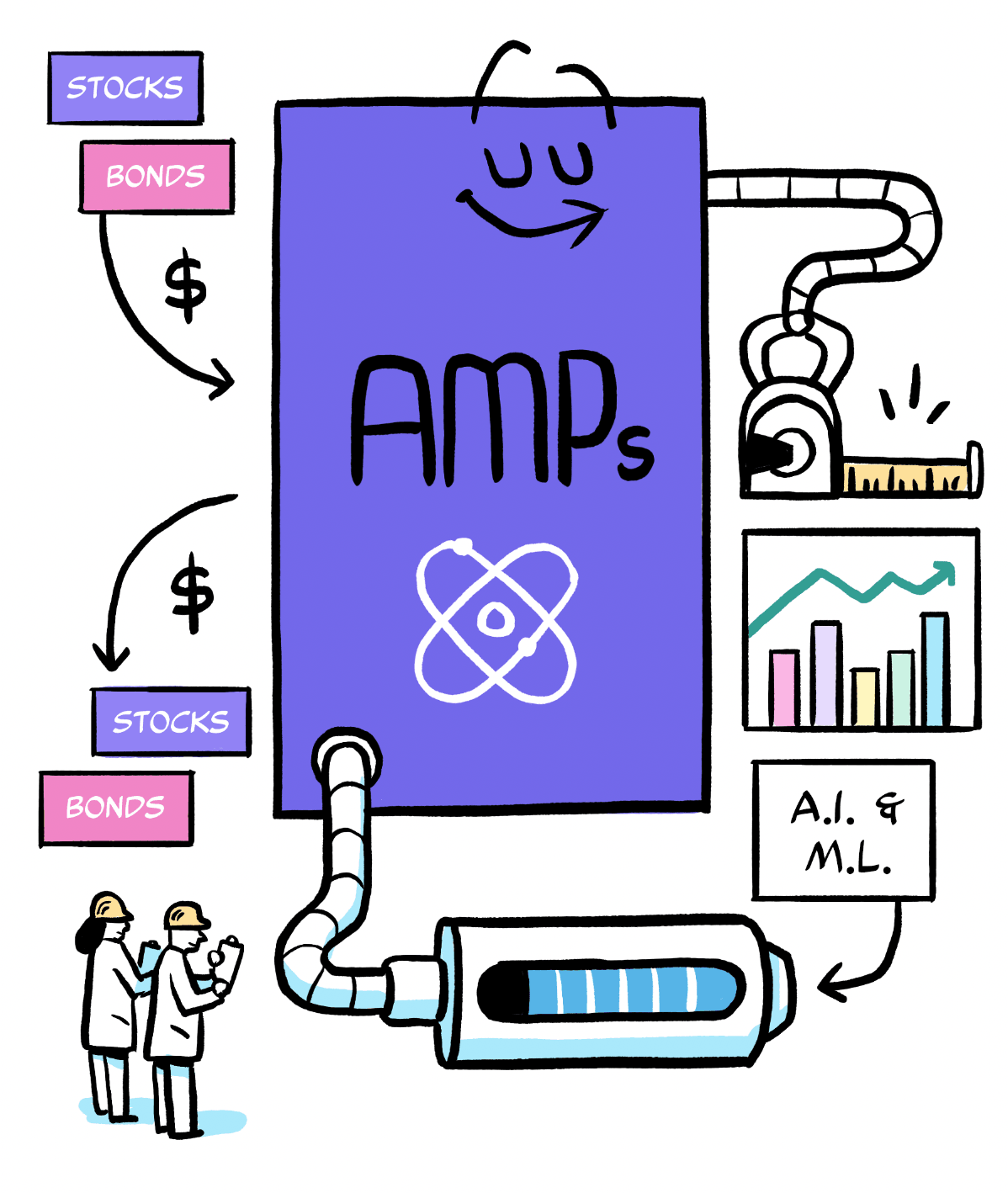

AMPs are tech-powered investment portfolios that evolve to help achieve your financial goals and adapt to changing market conditions.

AMPs help you diversify your investments in public assets.

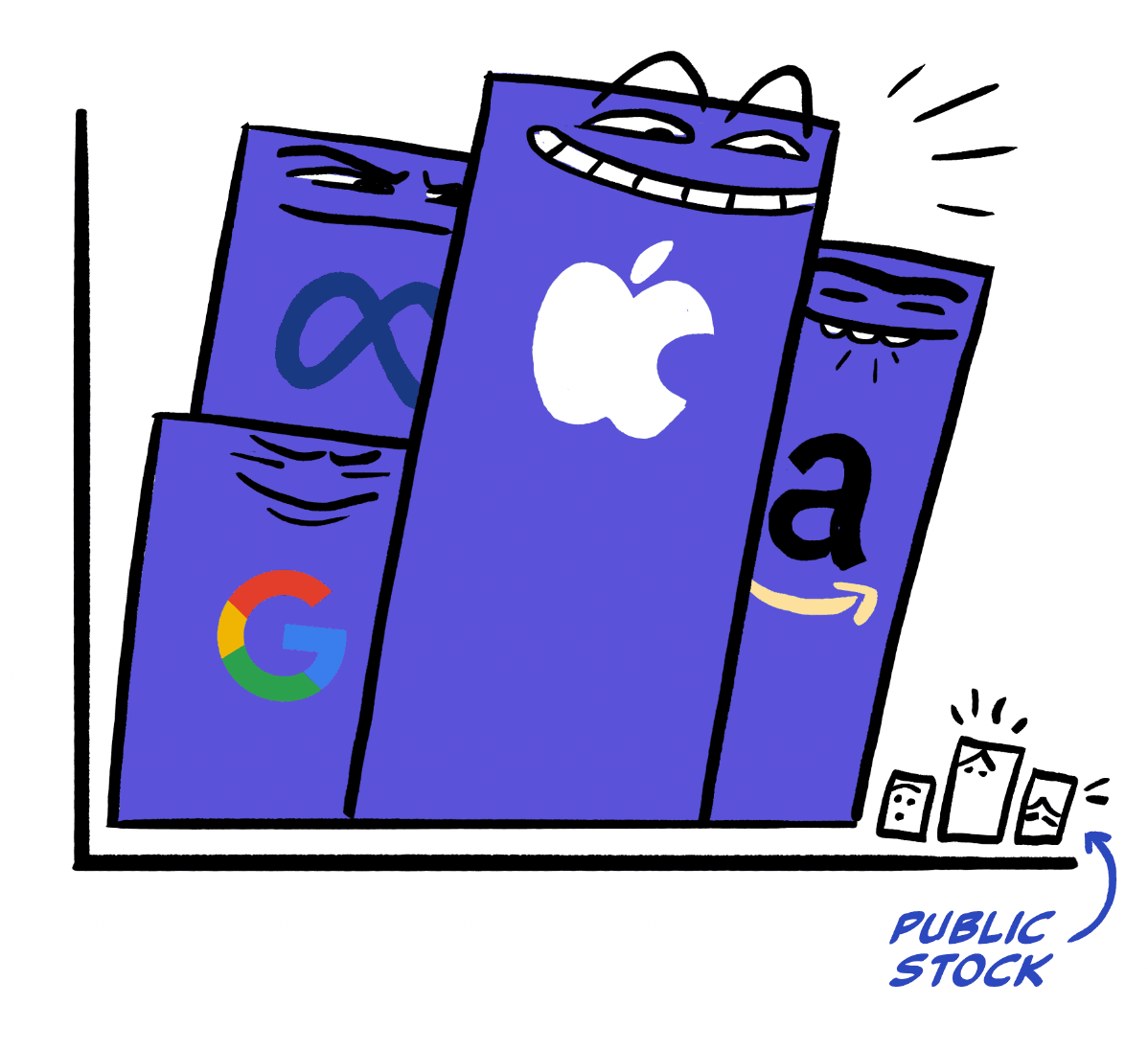

Did you know that tech stocks make up around 30% of the total value of the S&P 500?

So, if you're buying index funds and ETFs, you’re getting a lot of exposure to tech.

If you already have a lot of exposure to the technology industry — say, through your tech company stock grants — you could be over-concentrated in tech.

An AMP can help you with that!

AMPs are naturally diversified, selecting from a universe of public market ETFs, giving you broad exposure to the US public market without too much concentration in any single industry.

AMPs also reduce turbulence in a portfolio by investing in industries that have less volatility.

Tech's proportion in AMPs tends to be lower — from around 5% to 20%1— because it is more volatile relative to other industries.

This helps if you want to lessen your exposure to tech, but still aim to grow with the market.

OK! Those are a few ways Arta can help you move from being over-concentrated in a single asset to a well diversified portfolio!

Footnotes

- Based on backtested data. See important disclosures regarding hypothetical and backtested data here.

Do you want in?

Create an account in an instant

Sharing is caring

Disclosures

We believe the information presented to be accurate as of the date published and such information may not be updated in the future.

The information contained in this communication is provided for general informational purposes only, and should not be construed as investment or tax advice. Nothing in this communication should be construed as a solicitation, offer, or recommendation, to buy or sell any security.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Arta Finance or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Copyright Arta Finance 2026. All rights reserved.

Get the latest market trends and investment insights